NAHB Provided Nearly $300K to 18 HBAs in 2023 to Address Key Housing Priorities

While NAHB has established a well-deserved reputation on Capitol Hill as an elite power player that wields influence to get pro-housing bills introduced and passed, the association’s Intergovernmental Affairs team is also delivering concrete results by fighting every day on behalf of our state and local home builders associations on major issues that affect our members’ bottom lines.

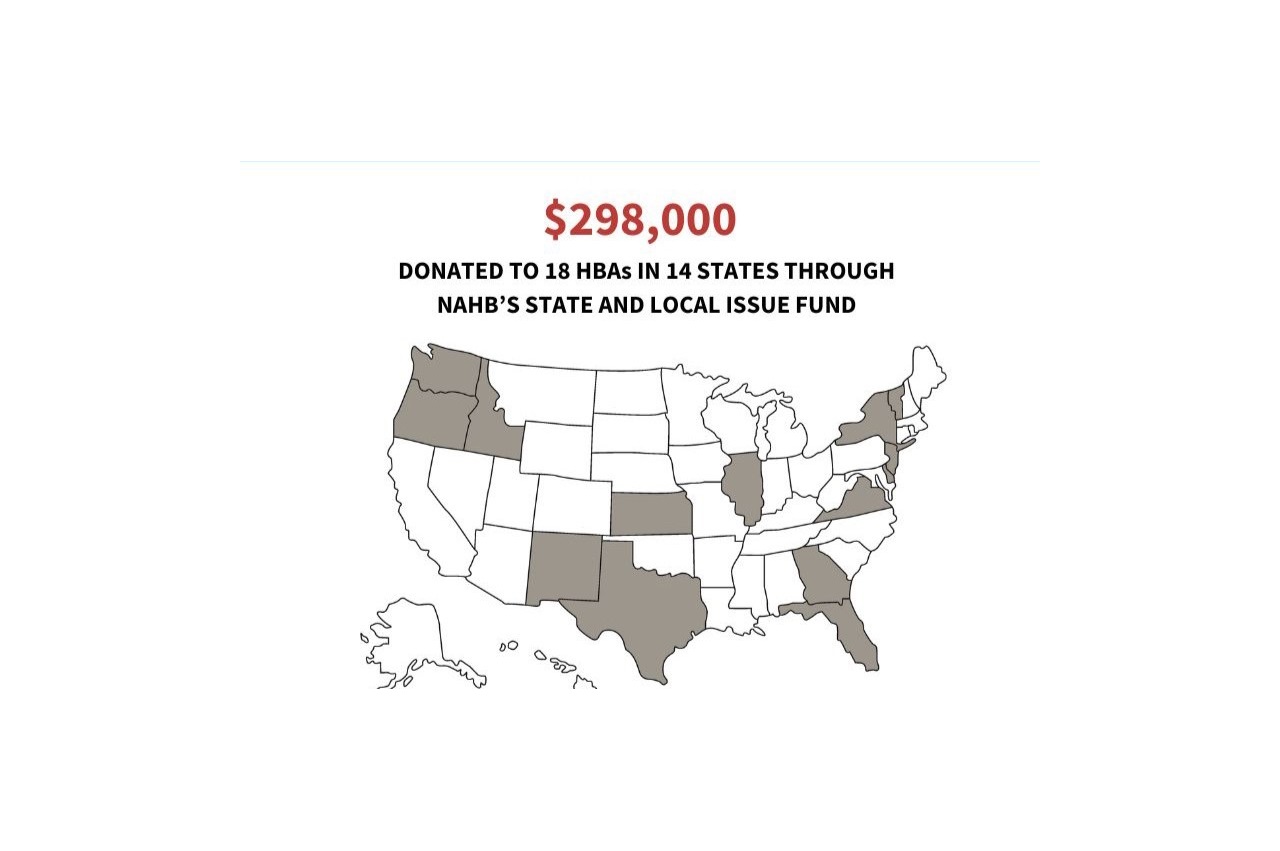

Through its State and Local Issues Fund, which provides financial assistance to HBAs involved in advocacy efforts on issues affecting the affordability of homeownership, NAHB distributed $298,000 to 18 HBAs in 14 states during 2023. Here are a few notable success stories:

- HBA of Greater Austin. The Austin City Council passed new code amendments for the first phase of the “Home Options for Middle-Income Empowerment” (HOME) Initiative, with a 9-2 supermajority. The approved code amendments are among a series of updates to the city’s Land Development Code (LDC), which governs land use regulations in Austin, intending to provide more housing types and increase housing supply within single-family zoned areas of Austin.

- Home Builders Association of Delaware. The HBA of Delaware worked to overcome potential mandatory fire sprinkler installation requirements in all new construction in New Castle County, Del., which would have added thousands of dollars to the cost of a home.

- HBA of Greater Portland. NAHB helped the local HBA defeat a ballot measure that would have established a countywide 0.75% capital gains tax to fund a tenant resource program to designed to provide legal representation for tenants in eviction proceedings. Builders and members of the business community successfully argued that the ballot tax measure would create an unlimited, adjustable tax on capital gains that applies to everyone living in Multnomah County, including home owners, seniors, small business owners and families.

- Building Industry Association of Washington. With NAHB’s help, the BIA of Washington established a successful campaign school program that is ongoing. This is an invaluable tool for anyone who is interested in running for office or working on political campaigns that will promote your business interests.

Impacting Local Legislation and Regulations

NAHB works tirelessly to create a better business environment for all those involved in the residential construction industry by tracking more than 3,500 housing-related bills in all 50 states that could affect our members.

Looking back on 2023, here are a few highlights of when local and state HBAs shined a light on key issues, challenged regulations that do more harm than good, and fought to level the playing field against powerful interests that could put struggling builders, remodelers and their suppliers out of business:

- Builders contribute to sweeping housing reforms in Montana. Several new laws signed into law will boost the housing supply and expand consumer choice in the state.

- State HBAs work with governors to address housing affordability. NAHB members in Massachusetts and New Mexico are working with leadership in the state houses on both sides of the aisle to advance pro-housing legislation.

- Alabama builders achieve codes victory. The Alabama HBA supported a bill signed into law earlier this year that prevents new home construction costs from increasing.

- Michigan builders score legislative victories. The HBA of Michigan dedicated a tremendous amount of time and effort in the last two years advocating for policies designed to increase workforce housing production across the state. Governor Gretchen Whitmer has signed several of these promising initiatives into law.

The NAHB Intergovernmental Affairs team participates in advocacy events across the nation. HBAs that seek assistance on analysis and strategy of bills that are affecting their communities are encouraged to contact Karl Eckhart, vice president of Intergovernmental Affairs, 202-266-8319.

Learn more how NAHB resources help members and HBAs advocate for a healthy housing market in their communities.

Latest from NAHBNow

Mar 03, 2026

Delaware Home Builders Score Permitting VictoryMembers sustained advocacy efforts helped shape an executive order designed to fast-track development and improve housing affordability in the state.

Mar 02, 2026

Top 10 States for NGBS Green Certification Activity in 2025Texas once again tops multifamily certification, and Florida took the top spot for most single-family certifications for the second consecutive year.

Latest Economic News

Feb 27, 2026

Gains for Student Housing Construction in the Last Quarter of 2025Private fixed investment for student dormitories was up 1.5% in the last quarter of 2025, reaching a seasonally adjusted annual rate (SAAR) of $3.9 billion. This gain followed three consecutive quarterly declines before rebounding in the final two quarters of the year.

Feb 27, 2026

Price Growth for Building Materials Slows to Start the YearResidential building material prices rose at a slower rate in January, according to the latest Producer Price Index release from the Bureau of Labor Statistics. This was the first decline in the rate of price growth since April of last year. Metal products continue to experience price increases, while specific wood products are showing declines in prices.

Feb 26, 2026

Home Improvement Loan Applications Moderate as Borrower Profile Gradually AgesHome improvement activity has remained elevated in the post-pandemic period, but both the volume of loan applications and the age profile of borrowers have shifted in notable ways. Data from the Home Mortgage Disclosure Act (HMDA), analyzed by NAHB, show that total home improvement loan applications have eased from their recent post-pandemic peak, and the distribution of borrowers across age groups has gradually tilted older.