3 Ways to Deliver a Personalized Experience for Home Buyers

Today’s home buyer doesn’t just want a personalized purchasing experience — they expect it. And the numbers speak for themselves:

- 70% of buyers expect personalized interactions with businesses

- 76% of customers get frustrated when companies don’t deliver personalized interactions

- The fastest-growing companies drive 40% more revenue from personalization than their counterparts.

A home is arguably the most personal product in the world. So home builders must incorporate the right technology — like online buyer experiences and 3D visualizations — into their business to enable the personalized experience today’s home buyers want and expect.

By being authentic, understanding your audience, and embracing technology, you can enhance your brand and provide a personalized experience for customers – making you a builder of choice.

Use Human-Centric Messaging

People don’t just buy products; they are buying better versions of themselves. When a home builder can authentically help buyers see themselves living better lives and achieving their aspirations by engaging with their product, that product becomes more valuable and differentiated.

Prospective buyers are more likely to choose your brand over competitors when they see themselves in your product and story.

Close Sales through Personalization

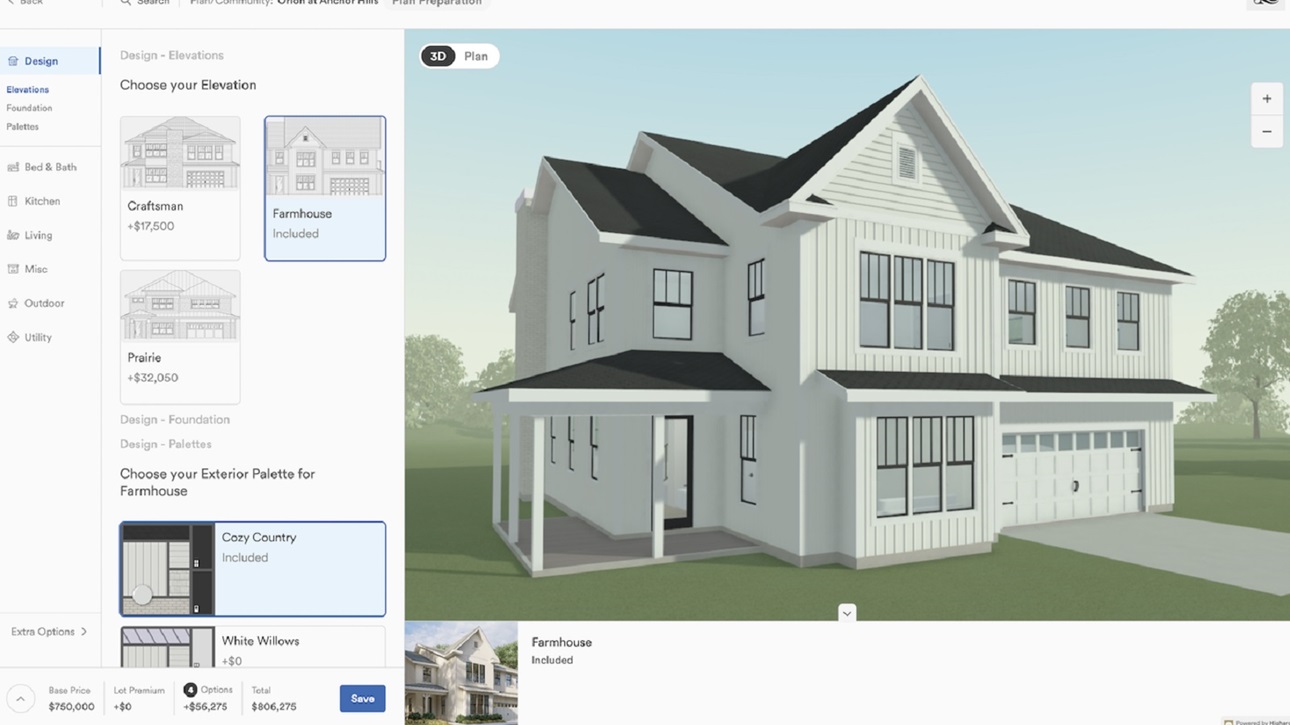

What if you could bring the high-touch, personal experience buyers get in a Design Center right to the buyer’s home? And in doing so, speed up the sales cycle?

Giving buyers a level of control to make decisions about their home and visualize it in the process can empower them to truly build a home they love that fits their needs and preferences.

This personalization in the sales cycle doesn’t just benefit buyers. It also helps you as the home builder by easily increasing option take rates and earning more revenue in each transaction.

Scale with Technology

Every home builder knows you need the right tools to get the job done. And that means adopting the right technology to make personalization in the home building process successful.

But offering a personalized buyer experience to every buyer, every time, and everywhere is nearly impossible without technology.

A solution like Higharc can easily enable you to offer buyers online home customization – with gorgeous 3D visuals and real-time pricing – while streamlining your workflows to deliver results. From automated, lot-specific CDs to true-to-plan marketing collateral, all of your systems will benefit from a connected cloud platform, allowing you to scale a unique buyer experience and boost your bottom line.

Personalization in the home building process is much more than a trendy strategy — it’s a paradigm shift that’s already transformed countless industries.

Home builders who use Higharc have experienced incredible results, averaging a 100% increase in plan configuration speed, a 50% decrease in plan-related variances, and a 28% increase in contract-to-close speed. Technology is working for them, empowering their teams to bring homes to market faster and meet the current demand for housing.

Curious to learn how Higharc can help you improve your buyer experience and improve your revenue? Learn more about Higharc or connect with one of their solutions consultants today.

Latest from NAHBNow

Mar 03, 2026

Delaware Home Builders Score Permitting VictoryMembers sustained advocacy efforts helped shape an executive order designed to fast-track development and improve housing affordability in the state.

Mar 02, 2026

Top 10 States for NGBS Green Certification Activity in 2025Texas once again tops multifamily certification, and Florida took the top spot for most single-family certifications for the second consecutive year.

Latest Economic News

Mar 03, 2026

Multifamily Absorption Rate Remains Below 50%The percentage of new apartment units that were absorbed within three months after completion was unchanged for new units completed in the second quarter, according to the Census Bureau’s latest release of the Survey of Market Absorption of New Multifamily Units (SOMA).

Mar 02, 2026

Private Residential Construction Spending Edges Higher in DecemberPrivate residential construction spending was up 1.5% for the last month of 2025. This modest gain was driven primarily by increased spending on home improvements and single-family construction. Despite this increase, total spending remained 1.3% lower than a year ago, reflecting the continued impact of housing affordability challenges facing the sector.

Mar 02, 2026

2024 Home Improvement Loan Applications: A State- and County-Level AnalysisResidential improvement activity remained solid in 2024, though growth has moderated from the surge seen in 2022.