The Fed’s Easing Cycle Finally Begins

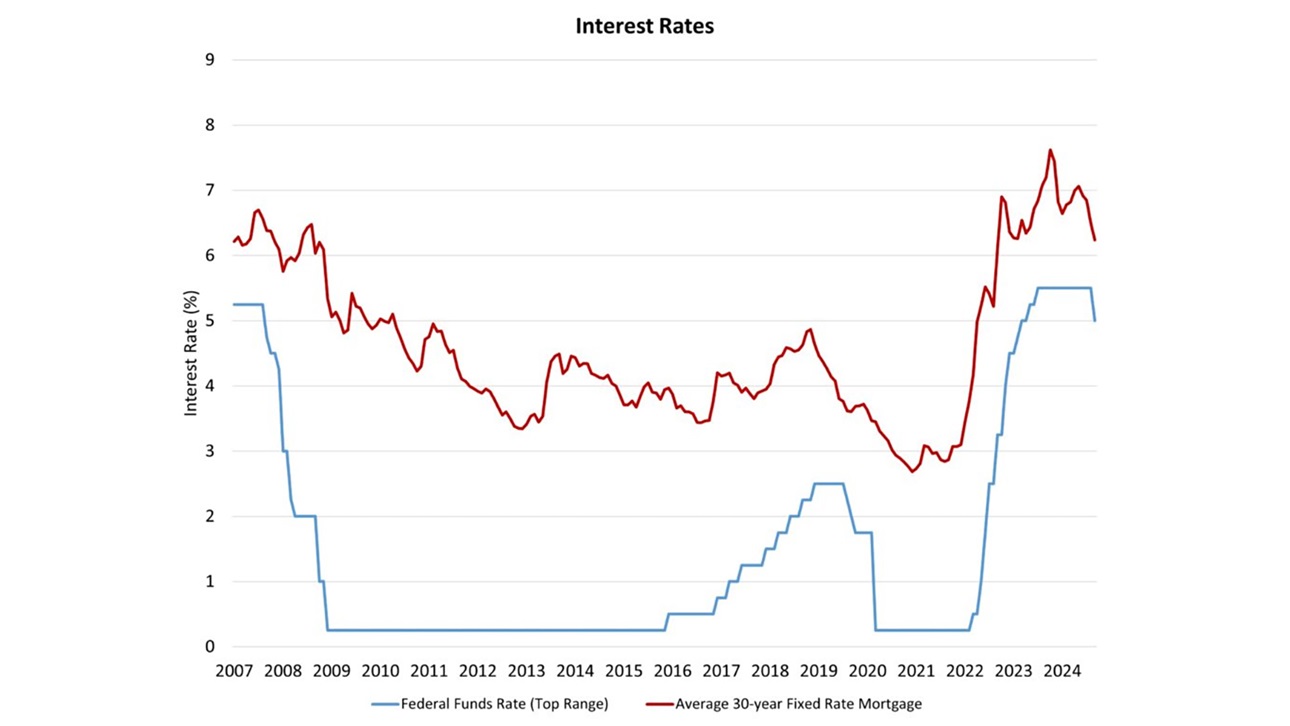

After its first post-COVID rate hike enacted more than two years ago, the Federal Reserve’s Federal Open Market Committee (FOMC) announced a significant reduction for the short-term federal funds rate at its September meeting. Tight monetary policy was undertaken to fight the worst bout of inflation in four decades. Today’s policy action marks the beginning of a series of rate decreases necessary to normalize interest rates, and to rebalance monetary policy risks between inflation and concerns regarding the labor market.

The FOMC reduced its top target rate by 50 basis points from 5.5% (where it has been for more than a year) to a “still restrictive” 5%. This was a larger cut than NAHB’s forecast projected. In its statement explaining the change of policy, the FOMC noted:

“Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have slowed, and the unemployment rate has moved up but remains low. Inflation has made further progress toward the Committee’s 2 percent objective but remains somewhat elevated.”

With the above-noted progress for inflation, today’s action is the beginning of a series of federal funds rate cuts, which ultimately should decrease the top target rate to approximately 3% in the coming quarters, as the rate of inflation moves closer to the target rate of 2%.

The pace of these future expected cuts is somewhat open to debate. Fed Chair Jerome Powell noted in his press conference that if weakening conditions require it, the Fed can move quickly. The central bank can also move more slowly if inflation and macro conditions require a more gradual transition.

As stated, today’s policy move reflects that the Fed has shifted from a primary policy focus of reducing inflation to balancing the goals of both price stability and maximum employment (with perhaps a greater concern being the labor market). Inflation does not need to be reduced to the central bank’s target of a 2% growth rate for the Fed to cut further; rather, inflation just needs to be on the path to reaching that goal (likely in late 2025 or early 2026).

The Fed’s economic projections imply an additional 50 basis points of rate cuts for 2024, followed by 150 more in 2025 and 2026. This FOMC projection implies a terminal federal funds rate for this cycle of approximately 3%, consistent with NAHB’s forecast for the medium-term outlook.

NAHB Chief Economist Dr. Robert Dietz delves into the impacts this action will have on both mortgage rates and builder and developer loans in this Eye on Housing post.

Latest from NAHBNow

Mar 09, 2026

Watch Video Highlights from the Leadership Meetings at the 2026 IBSNAHB members who were unable to join us in Orlando, Fla., this February for the leadership meetings at the 2026 International Builders' Show can watch some of the highlights on nahb.org.

Mar 06, 2026

NAHB Court Win Vacates HUD 2021 IECC MandateA recent court decision in a case brought by NAHB and 15 states pertaining to federal energy code mandates is a major win for our members, housing affordability and common-sense regulations.

Latest Economic News

Mar 06, 2026

U.S. Economy Loses 92,000 Jobs in FebruaryThe U.S. labor market weakened in February, as payroll employment declined and the unemployment rate rose to 4.4%. The cooling labor market could place the Federal Reserve in a challenging position as policymakers weigh slower job growth against inflation pressures from rising oil prices.

Mar 05, 2026

Builders Identify Key Long-Term Forces Shaping Housing Demand and Industry HealthHome builders are keenly aware of the complex long-term outlook ahead for the home building industry. A recent NAHB/Wells Fargo HMI survey asked builders to assess the impact of 14 major trends and forces on the health of the industry and housing demand over the next 10 years.

Mar 05, 2026

Affordability Posts Mild Gains in Second Half of 2025 but Crisis ContinuesThough new and existing homes remain largely unaffordable, the needle moved slightly in the right direction in the second half of 2025, according to the latest data from the National Association of Home Builders (NAHB)/Wells Fargo Cost of Housing Index (CHI).