Existing Home Sales Edge Higher in July

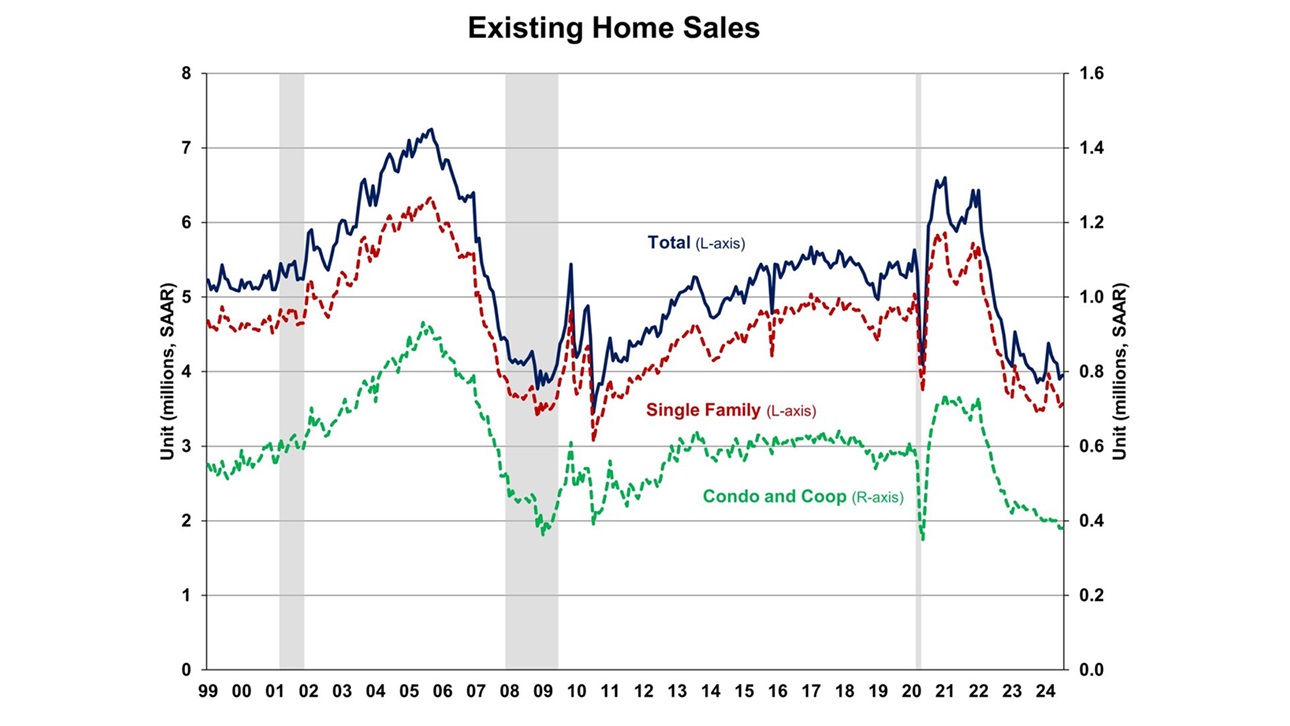

Existing home sales increased for the first time in five months, according to the National Association of Realtors, as improving inventory and declining mortgage rates motivated more prospective buyers to act.

Despite these changes, sales remained sluggish and low inventory continued to push up median home prices. However, NAHB expects increased activity in the coming months as mortgage rates continue to moderate. Improving inventory is likely to ease home price growth and enhance housing affordability.

Home owners with lower mortgage rates have opted to stay put, avoiding trading existing mortgages for new ones with higher rates. This "lock-in" trend is driving home prices higher and holding back inventory. Mortgage rates are expected to continue to decrease gradually, leading to increased demand (and unlocking more of the lock-in inventory) in the coming quarters.

Total existing home sales rose 1.3% to a seasonally adjusted annual rate of 3.95 million in July. This marks the first increase after four months of declines. On a year-over-year basis, sales were still 2.5% lower than a year ago.

At the current sales rate, July unsold inventory sits at a 4.0-month supply (down from 4.1 last month, but up from 3.3 a year ago). This inventory level remains low compared to balanced market conditions (a 4.5- to 6-month supply) and illustrates the long-run need for more home construction.

The July median sales price of all existing homes was $422,600, up 4.2% from last year. This marked the 13th consecutive month of year-over-year increases. The median condominium/co-op price in July was up 2.7% from a year ago at $367,500. This rate of price growth will slow as inventory increases.

NAHB Senior Economist Fan-Yu Kuo provides more details, including regional and demographic breakdowns, in this Eye on Housing post.

Latest from NAHBNow

Feb 27, 2026

Senate Bill Would Exclude Building Materials from TariffsNAHB worked with Sens. Jacky Rosen (D-Nev.) and Chris Coons (D-Del.) to introduce legislation that would address the housing affordability crisis by creating an exemption process for building materials from tariffs.

Feb 27, 2026

New Army Corps Initiative Will Streamline Permitting ProcessThe Army Corps of Engineers on Feb. 23 announced a new initiative called “Building Infrastructure, Not Paperwork” that the agency said will “shorten permitting timelines, and reduce or eliminate extraneous regulations and paperwork.”

Latest Economic News

Feb 27, 2026

Gains for Student Housing Construction in the Last Quarter of 2025Private fixed investment for student dormitories was up 1.5% in the last quarter of 2025, reaching a seasonally adjusted annual rate (SAAR) of $3.9 billion. This gain followed three consecutive quarterly declines before rebounding in the final two quarters of the year.

Feb 27, 2026

Price Growth for Building Materials Slows to Start the YearResidential building material prices rose at a slower rate in January, according to the latest Producer Price Index release from the Bureau of Labor Statistics. This was the first decline in the rate of price growth since April of last year. Metal products continue to experience price increases, while specific wood products are showing declines in prices.

Feb 26, 2026

Home Improvement Loan Applications Moderate as Borrower Profile Gradually AgesHome improvement activity has remained elevated in the post-pandemic period, but both the volume of loan applications and the age profile of borrowers have shifted in notable ways. Data from the Home Mortgage Disclosure Act (HMDA), analyzed by NAHB, show that total home improvement loan applications have eased from their recent post-pandemic peak, and the distribution of borrowers across age groups has gradually tilted older.