Nearly Half of U.S. Households Can’t Afford a $250,000 Home

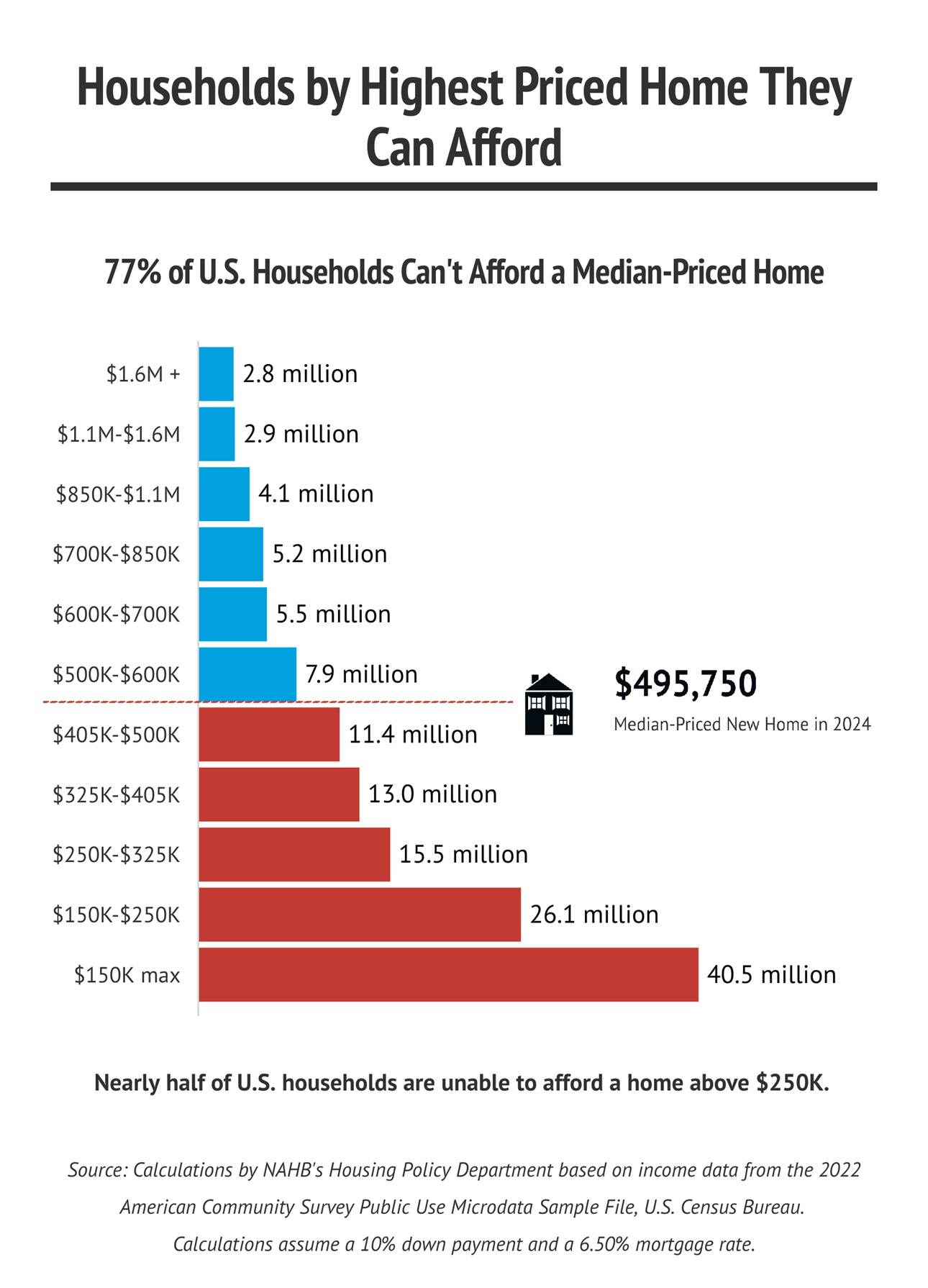

NAHB has updated its housing affordability graph for 2024, and the latest data show that 66.6 million households, 49% out of a total of 134.9 million, are unable to afford a $250,000 home.

The graph is based on conventional underwriting standards that assume the cost of a mortgage, property taxes and property insurance should not exceed 28% of household income. Based on this methodology, NAHB economists have calculated how many households have enough income to afford a home at various price thresholds.

For example, the minimum income required to purchase a $150,000 home with a mortgage rate of 6.5% is $45,975. At the base of the graph are 40.5 million U.S. households with insufficient incomes (below $45,975) to be able to afford a $150,000 home.

The graph’s second step consists of 26.1 million with enough income to afford a top price somewhere between $150,000 and $250,000. Adding up the bottom two rungs shows that there are 66.6 million households who cannot afford a $250,000 home.

The nationwide median price of a new single-family home is $495,750, meaning half of all new homes sold in the U.S. cost more than this figure and half cost less. A total of 134.9 million households — roughly 77% of all U.S. households — cannot afford this median-priced new home based on a mortgage rate of 6.5%.

The top of the graph shows that 9.8 million households (adding up the top three rungs) have enough income to buy a $850,000 home, and 2.8 million even have enough for a home priced at $1.6 million. But market analysts should never focus on this to the exclusion of the wider steps that support the graph’s base.

This graph clearly illustrates the nation’s housing affordability crisis. NAHB has put out a 10-point plan to address this urgent issue. The plan outlines initiatives that can be taken at the local, state and federal levels to address the root of the problem — impediments to increasing the nation’s housing supply.

Latest from NAHBNow

Mar 10, 2026

NAHB Announces 7 Fall Recruitment Competition WinnersFor their efforts, top Builder winners earned LG laundry machines, and Associate winners and all runners-up earned International Builders’ Show (IBS) VIP ticket packages, including registration to the show, IBS House Party tickets, opening ceremony seat reservations and VIP Closing Concert tickets.

Mar 09, 2026

Laura Dwyer Wins SA Walters Lifetime Achievement Award for Systems Built HousingThe NAHB Building Systems Councils has awarded the S.A. Walters Award for Lifetime Achievement in Systems Built Housing to Laura Dwyer, recognizing her decades of leadership, innovation, and service to the homebuilding industry.

Latest Economic News

Mar 10, 2026

AD&C Loan Volume Falls Despite Declining Financing CostsSingle-family construction lending fell in the fourth quarter, according to data released by the Federal Deposit Insurance Corporation (FDIC).

Mar 09, 2026

Lower Mortgage Rates Boost Refinancing While Purchase Activity SlowsMortgage application activity increased month-over-month as the 30-year fixed mortgage rates reached a three-year low.

Mar 06, 2026

U.S. Economy Loses 92,000 Jobs in FebruaryThe U.S. labor market weakened in February, as payroll employment declined and the unemployment rate rose to 4.4%. The cooling labor market could place the Federal Reserve in a challenging position as policymakers weigh slower job growth against inflation pressures from rising oil prices.