Top Challenges for Builders in 2024

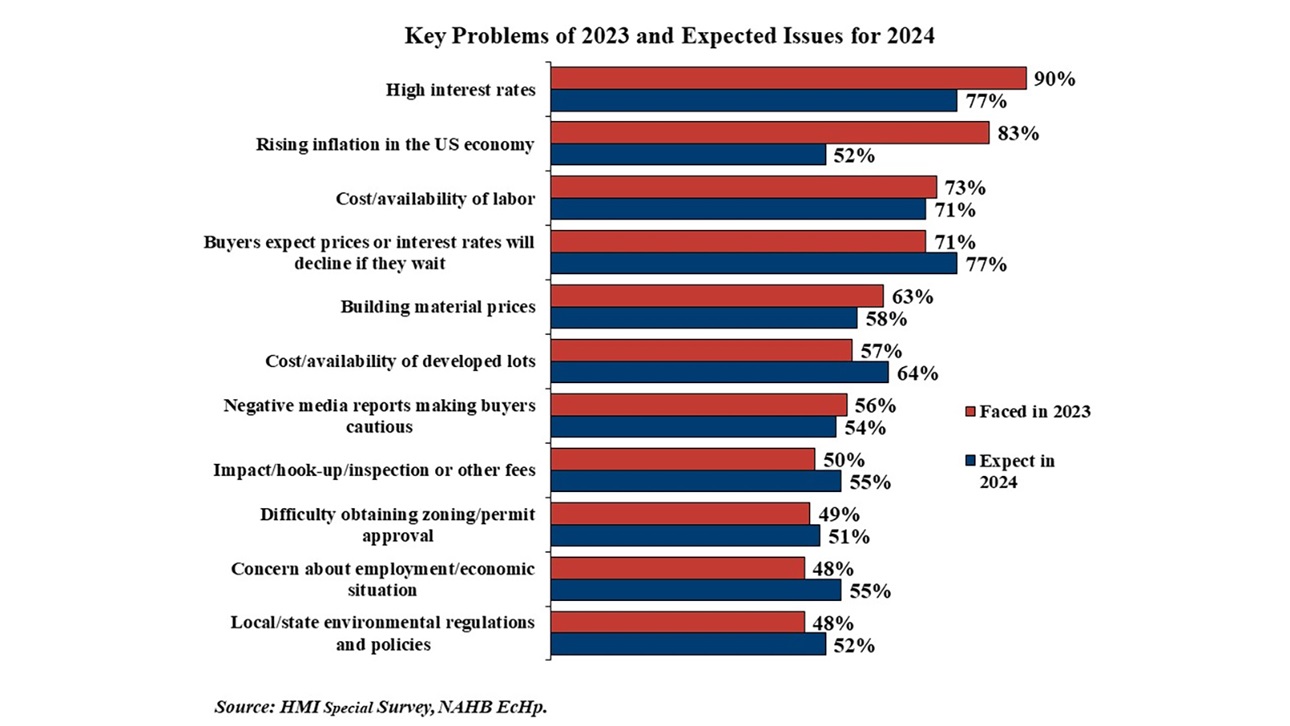

According to the January 2024 survey for the NAHB/Wells Fargo Housing Market Index (HMI), high interest rates were a significant issue for 90% of builders in 2023, and 77% expect them to be a problem in 2024. The second most widespread problem in 2023 was rising inflation, cited by 83% of builders, with 52% expecting it to be a problem in 2024.

Concerns over the cost and availability of labor have increased significantly in recent years, rising from only 13% of builders in 2011 to its peak at 87% in 2019. Fewer builders reported this problem in 2020 (65%), but the share rose again in 2021 (82%) and 2022 (85%). The share eased slightly in 2023 to 74%, and 75% expect the cost and availability of labor to remain a significant issue in 2024.

The share of builders experiencing significant problems with building materials prices has fluctuated over the years as well, reaching as low as 33% in 2011 to a peak of 96% in 2020, 2021 and 2022. The slowdown in single-family construction in 2023 made this less of a problem for builders last year, with 63% reporting it as a significant issue. Fewer (58%) expect it to remain an issue in 2024.

Compared to the supply-side problems of materials and labor, problems attracting buyers have not been as widespread, but builders expect many of them to become more of a problem in 2024. Buyers expecting prices or interest rates to decline if they wait was a significant problem for 71% of builders in 2023, with 77% expecting it to be an issue in 2024. A majority of builders (56%) also cited negative media reports making buyers cautious as a significant issue that is expected to continue in 2024.

NAHB Senior Economist Ashok Chaluvadi provides more details in this Eye on the Economy post, as well as a download to the full survey report.

Latest from NAHBNow

Mar 02, 2026

NAHB Student Competition Success Shows Residential Construction Future is BrightFor two days at the International Builders' Show, aspiring land developers, designers and project managers from NAHB Student Chapters across the country presented thorough building proposals and fielded tough questions from an audience of construction company executives.

Feb 27, 2026

Senate Bill Would Exclude Building Materials from TariffsNAHB worked with Sens. Jacky Rosen (D-Nev.) and Chris Coons (D-Del.) to introduce legislation that would address the housing affordability crisis by creating an exemption process for building materials from tariffs.

Latest Economic News

Feb 27, 2026

Gains for Student Housing Construction in the Last Quarter of 2025Private fixed investment for student dormitories was up 1.5% in the last quarter of 2025, reaching a seasonally adjusted annual rate (SAAR) of $3.9 billion. This gain followed three consecutive quarterly declines before rebounding in the final two quarters of the year.

Feb 27, 2026

Price Growth for Building Materials Slows to Start the YearResidential building material prices rose at a slower rate in January, according to the latest Producer Price Index release from the Bureau of Labor Statistics. This was the first decline in the rate of price growth since April of last year. Metal products continue to experience price increases, while specific wood products are showing declines in prices.

Feb 26, 2026

Home Improvement Loan Applications Moderate as Borrower Profile Gradually AgesHome improvement activity has remained elevated in the post-pandemic period, but both the volume of loan applications and the age profile of borrowers have shifted in notable ways. Data from the Home Mortgage Disclosure Act (HMDA), analyzed by NAHB, show that total home improvement loan applications have eased from their recent post-pandemic peak, and the distribution of borrowers across age groups has gradually tilted older.