Quarter-Point Mortgage Rate Hike Knocks 1.3 Million Households Out of Market

In today’s interest rate environment, a quarter-point rise in mortgage rates would price approximately 1.3 million households out of the market for a new home with an estimated median price of $425,786, according to the latest analysis by NAHB. And if the Federal Reserve moves later today to continue to hike interest rates, this will put upward pressure on mortgage rates.

Monthly mortgage payments would increase as a result of rising mortgage interest rates, and therefore, higher household income thresholds would be needed to qualify for a mortgage. In other words, a quarter-point rate hike would force potential buyers to set their sights on a house selling lower than a median-priced home.

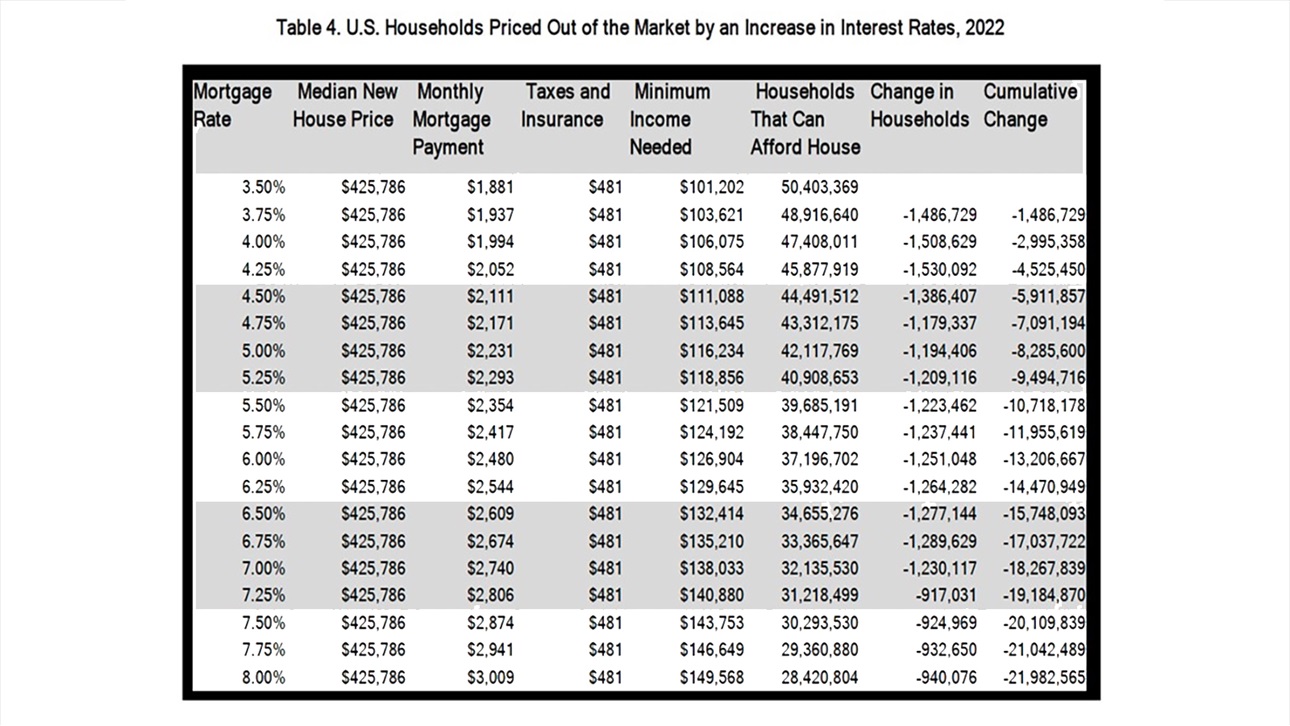

The table below shows the number of households priced out of the market for a new median-priced home at $425,786 for each 25 basis-point increase in interest rates from 3.5% to 8%. When interest rates increase from 6.25% to 6.5%, approximately 1.28 million households can no longer afford to buy a median-priced new home. An increase from 6.5% to 7% prices approximately 1.29 million more households out of the market.

As interest rates rise higher, fewer households are priced out of the market for a median-priced home because only a declining number of households at the higher end of household income distribution would be affected. When interest rates are relatively low, a 25 basis-point increase would affect a larger number of households at the lower and more populous part of income distribution.

Another recent report from NAHB shows how many households in individual states and metro areas would be priced out of a home for each $1,000 increase in the price of a home.

NAHB Principal Economist Na Zhao provided this analysis in a recent Eye on Housing blog post.

Latest from NAHBNow

Mar 04, 2026

NAHB's Monthly Update Highlights Advocacy PrioritiesThe talking points this month feature news related to President Trump’s tariffs and NAHB’s 2026 economic outlook.

Mar 03, 2026

National Labor Relations Board Restores 2020 Joint Employer StandardLate last week, the National Labor Relations Board (NLRB) issued a final revision of regulations governing the standard for determining joint employer status under the National Labor Relations Act (NLRA).

Latest Economic News

Mar 03, 2026

Multifamily Absorption Rate Remains Below 50%The percentage of new apartment units that were absorbed within three months after completion was unchanged for new units completed in the second quarter, according to the Census Bureau’s latest release of the Survey of Market Absorption of New Multifamily Units (SOMA).

Mar 02, 2026

Private Residential Construction Spending Edges Higher in DecemberPrivate residential construction spending was up 1.5% for the last month of 2025. This modest gain was driven primarily by increased spending on home improvements and single-family construction. Despite this increase, total spending remained 1.3% lower than a year ago, reflecting the continued impact of housing affordability challenges facing the sector.

Mar 02, 2026

2024 Home Improvement Loan Applications: A State- and County-Level AnalysisResidential improvement activity remained solid in 2024, though growth has moderated from the surge seen in 2022.