Materials Remain Top Challenge for Builders, but New Issues Are Becoming Increasingly Problematic

The price and availability of building materials again topped the list of problems builders faced last year, but interest rates, general inflation and negative media moved considerably up the list.

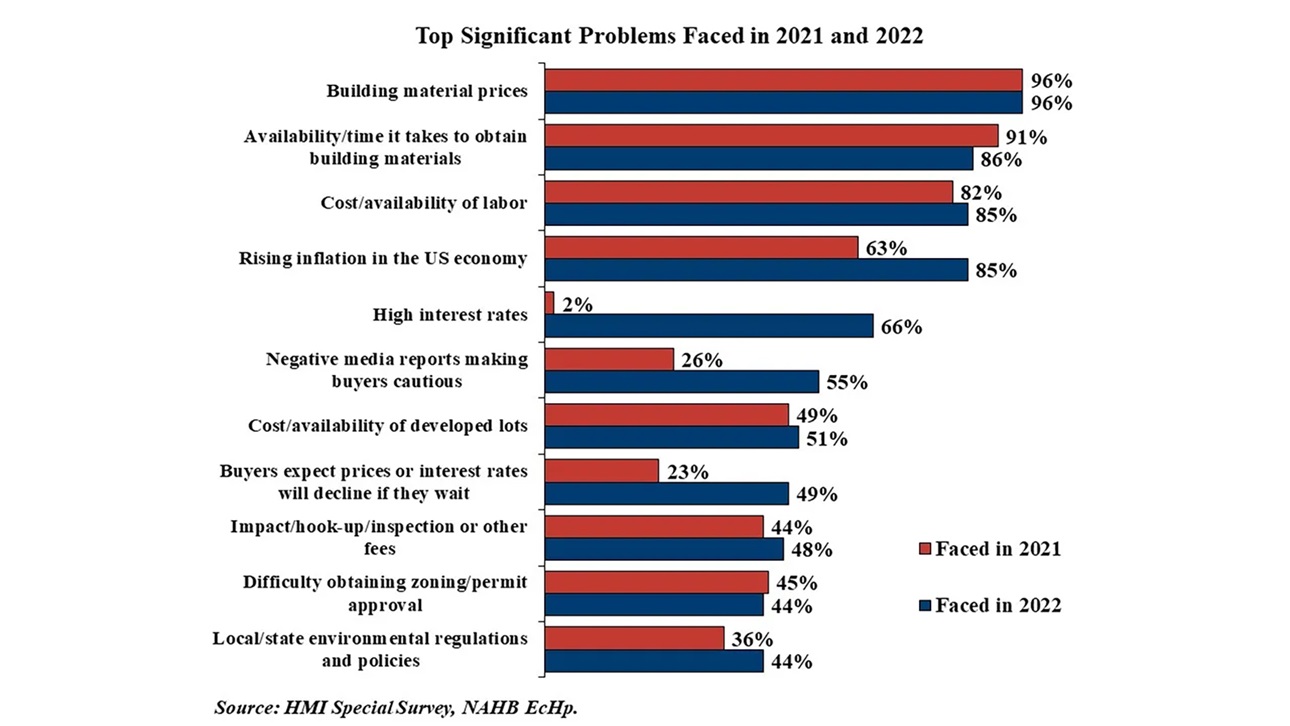

According to responses on the January 2023 survey for the NAHB/Wells Fargo Housing Market Index (HMI), building material prices were the most significant issue for builders in 2022 (cited by 96% of builders), followed by availability and timing to obtain building materials (cited by 86% of builders). Both problems topped the list in 2021 as well.

Cost and availability of labor has also been a relatively widespread problem, reported as a significant issue by 82% of builders in 2021 and 85% in 2022 — which is not surprising, given the large number of unfilled job openings in the construction industry.

However, some problems became significantly more widespread in 2022. High interest rates were a problem for only 2% of builders in 2021 but affected 66% of builders in 2022. Rising inflation in the U.S. economy was a significant problem for 85% of builders in 2022, compared to 63% in 2021. And negative media reports making buyers cautious also affected 55% of builders in 2022, compared to 26% in 2021.

More builders (93%) expect high interest rates to be a problem in 2023, up strongly from the 66% who said it was a problem in 2022. Moreover, both the current and expected numbers were much higher in the recent survey than at any time between 2011 and 2021.

NAHB senior economist Ashok Chaluvadi provides more insights in this Eye on Housing post.

Latest from NAHBNow

Feb 20, 2026

NAHB Announces Best of IBS Winners at International Builders’ ShowThe National Association of Home Builders (NAHB) named the winners of its 13th annual Best of IBS™ Awards during the NAHB International Builders’ Show® (IBS) in Orlando. The awards were presented during a ceremony held on the final day of the show.

Feb 20, 2026

How Land Developers are Leveraging AI to Move FasterAI is helping today's leading land development teams operate differently. By connecting data across ownership, zoning, infrastructure, and development activity, AI can surface early signals of opportunity and support faster, more informed go/no-go decisions

Latest Economic News

Feb 20, 2026

New Home Sales Close 2025 with Modest GainsNew home sales ended 2025 on a mixed but resilient note, signaling steady underlying demand despite ongoing affordability and supply constraints. The latest data released today (and delayed because of the government shutdown in fall of 2025) indicate that while month-to-month activity shows a small decline, sales remain stronger than a year ago, signaling that buyer interest in newly built homes has improved.

Feb 20, 2026

U.S. Economy Ends 2025 on a Slower NoteReal GDP growth slowed sharply in the fourth quarter of 2025 as the historic government shutdown weighed on economic activity. While consumer spending continued to drive growth, federal government spending subtracted over a full percentage point from overall growth.

Feb 19, 2026

Delinquency Rates Normalize While Credit Card and Student Loan Stress WorsensDelinquent consumer loans have steadily increased as pandemic distortions fade, returning broadly to pre-pandemic levels. According to the latest Quarterly Report on Household Debt and Credit from the Federal Reserve Bank of New York, 4.8% of outstanding household debt was delinquent at the end of 2025, 0.3 percentage points higher than the third quarter of 2025 and 1.2% higher from year-end 2024.