Top 10 Features for First-Time Home Buyers

The recent NAHB study, What Home Buyers Really Want, 2021 Edition, asked first-time buyers to rate more than 200 home and community features using a four-tier scale: essential, desirable, indifferent and do not want.

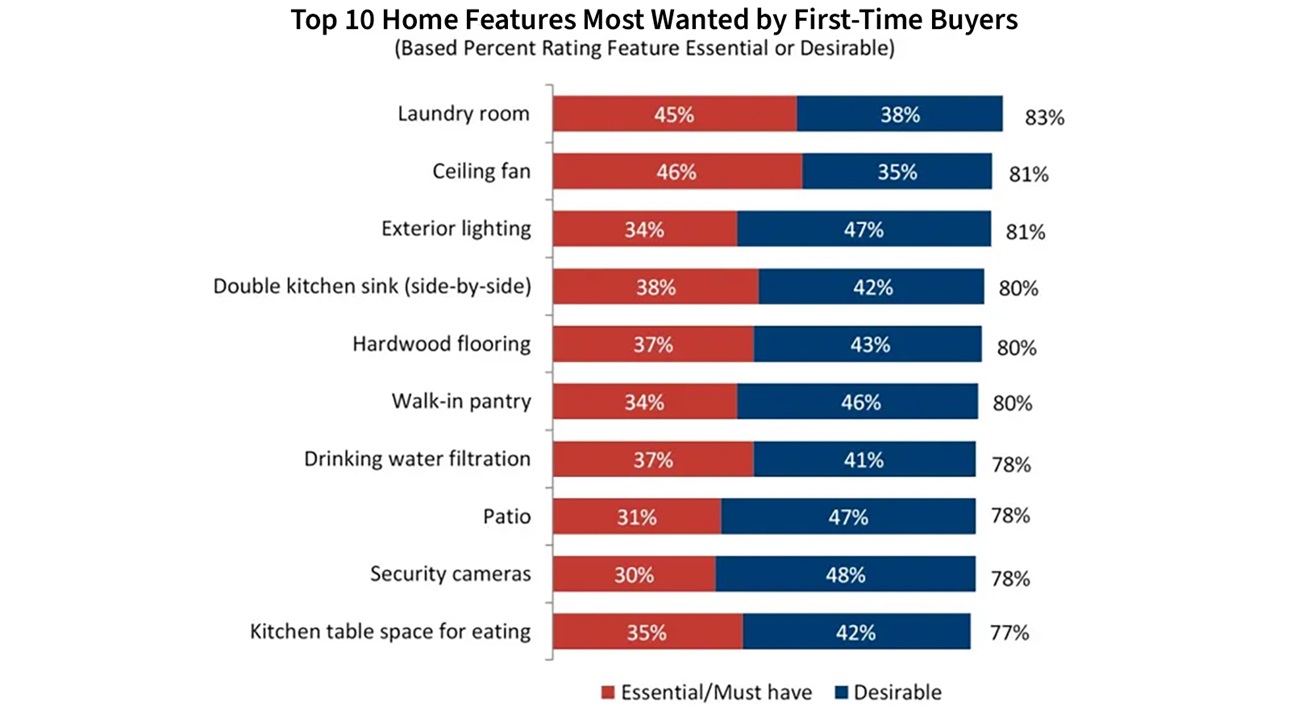

The chart below shows the 10 “most wanted” features for first-time home buyers, based on the percentage of buyers rating a feature either desirable or essential.

A laundry room tops the list, rated essential or desirable by 83% of first-time buyers, followed by a ceiling fan and exterior lighting, each rated essential or desirable by 81%. Four of the features most wanted by first-time buyers are kitchen features:

- A double kitchen sink and walk-in pantry (each rated essential or desirable by 80%),

- Drinking water filtration (78%) and

- Table space for eating (77%).

Two are outdoor features: a patio (rated essential or desirable by 78%) in addition to exterior lighting.

Rounding out the top 10 are hardwood flooring for main-floor living spaces (80%) and security cameras (78%).

The list of features most wanted by first-time buyers is similar to the list for home buyers in general, although buyers in general tend to give the features slightly higher ratings. A laundry room, for example, is No. 1 on both lists, but is rated essential or desirable by 87% of buyers overall, compared to 83 percent of the first-time buyers. The ratings of many features tend to be positively correlated with income, and first-time buyers have a median income of $65,000, compared to $79,000 for home buyers in general.

The most noticeable difference between the features most wanted by first-time buyers and buyers in general, however, is the absence of energy-saving features on the first-time buyers’ top 10 list. Among buyers in general, ENERGY STAR rated windows ranked No. 4 and ENERGY STAR rated appliances ranked No. 9. A front porch also made the top 10 list among buyers in general.

On the other hand, drinking water filtration, security cameras and a kitchen table for eating failed to make the top 10 list for buyers in general.

NAHB Vice President for Survey and Housing Policy Research Paul Emrath provides more housing trends in this Eye on Housing post.

Latest from NAHBNow

Mar 02, 2026

Top 10 States for NGBS Green Certification Activity in 2025Texas once again tops multifamily certification, and Florida took the top spot for most single-family certifications for the second consecutive year.

Mar 02, 2026

NAHB Student Competition Success Shows Residential Construction Future is BrightFor two days at the International Builders' Show, aspiring land developers, designers and project managers from NAHB Student Chapters across the country presented thorough building proposals and fielded tough questions from an audience of construction company executives.

Latest Economic News

Feb 27, 2026

Gains for Student Housing Construction in the Last Quarter of 2025Private fixed investment for student dormitories was up 1.5% in the last quarter of 2025, reaching a seasonally adjusted annual rate (SAAR) of $3.9 billion. This gain followed three consecutive quarterly declines before rebounding in the final two quarters of the year.

Feb 27, 2026

Price Growth for Building Materials Slows to Start the YearResidential building material prices rose at a slower rate in January, according to the latest Producer Price Index release from the Bureau of Labor Statistics. This was the first decline in the rate of price growth since April of last year. Metal products continue to experience price increases, while specific wood products are showing declines in prices.

Feb 26, 2026

Home Improvement Loan Applications Moderate as Borrower Profile Gradually AgesHome improvement activity has remained elevated in the post-pandemic period, but both the volume of loan applications and the age profile of borrowers have shifted in notable ways. Data from the Home Mortgage Disclosure Act (HMDA), analyzed by NAHB, show that total home improvement loan applications have eased from their recent post-pandemic peak, and the distribution of borrowers across age groups has gradually tilted older.