Fed Cuts Rate But Signals Slowing Pace of Easing Ahead

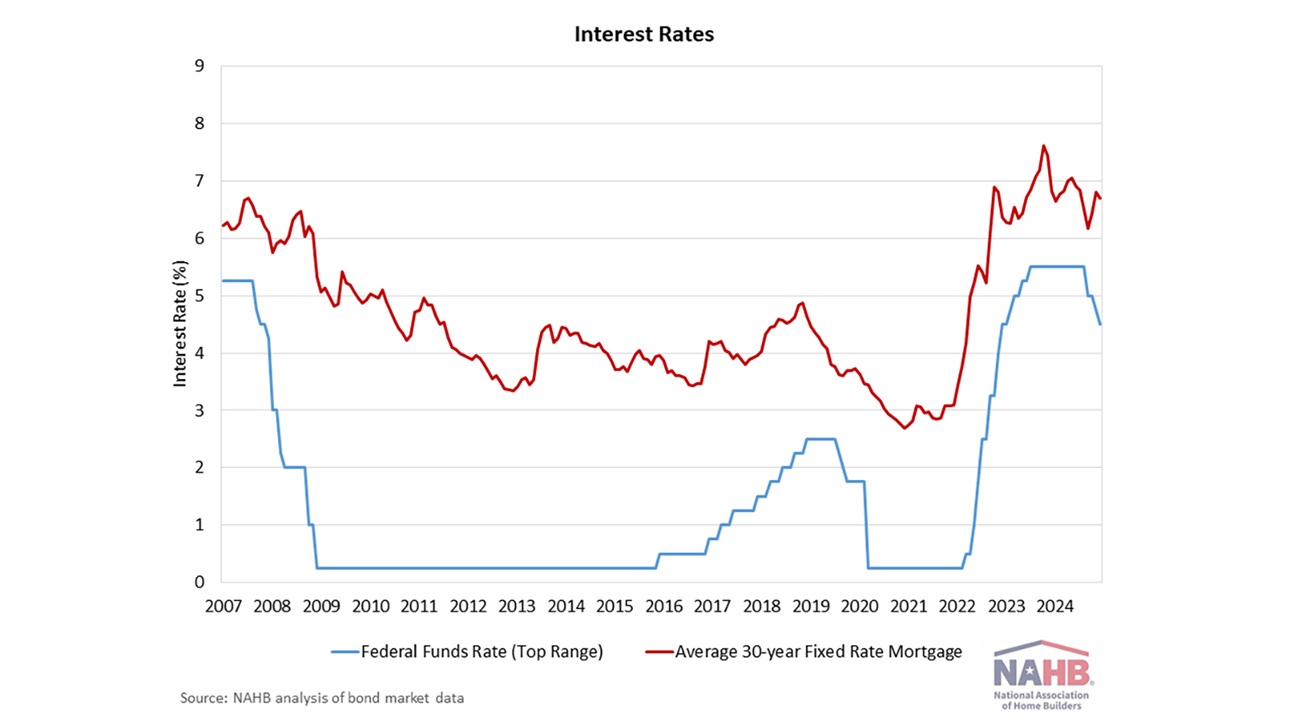

In a widely anticipated move, the Federal Reserve’s Federal Open Market Committee (FOMC) reduced the short-term federal funds rate by an additional 25 basis points at the conclusion of its December meeting. This policy move reduces the top target rate to 4.5%.

However, the Fed’s newly published forward-looking projections also noted a reduction in the number of federal funds rate cuts expected in 2025, from four in its last projection to just two 25 basis point reductions.

The new Fed projection envisions the federal funds top target rate falling to 4% by the end of 2025, with two more rate cuts in 2026, placing the federal funds top target rate to 3.5% at the end of 2026. One final rate is seen occurring in 2027.

The Fed also increased its estimate of the neutral, long-run rate (sometimes referred to as the terminal rate) from 2.9% to 3%, which is reflective of stronger expectations for economic growth and productivity gains.

For home builders and other residential construction market stakeholders, the new projections suggest an improved economic growth environment, one in which there is a smaller amount of monetary policy easing, leading to higher than previously expected interest rates for acquisition, development and construction (AD&C) loans. Thus, more economic growth but higher interest rates.

The statement from the December FOMC summarized current market conditions as:

Recent indicators suggest that economic activity has continued to expand at a solid pace. Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low. Inflation has made progress toward the Committee’s 2 percent objective but remains somewhat elevated.

NAHB Chief Economist Robert Dietz provides further insights in this Eye on Housing post.

Latest from NAHBNow

Mar 12, 2026

Statement from NAHB Chairman Bill Owens on Passage of Senate Housing BillNAHB Chairman Bill Owens issued the following statement after the Senate passed the 21st Century ROAD to Housing Act.

Mar 12, 2026

Single-Family Starts Remain Soft in January on Affordability ConcernsOverall housing starts increased 7.2% in January to a seasonally adjusted annual rate of 1.49 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

Latest Economic News

Mar 12, 2026

Single-Family Starts Remain Soft in January on Affordability ConcernsElevated construction costs and constrained affordability conditions led to a reduction in single-family housing starts in January.

Mar 11, 2026

Inflation Steady Before WarAfter months of downward trend, inflation held steady at an eight-month low in February. This report does not reflect the recent surge in oil prices due to Iran conflict beginning February 28. Higher oil prices will likely translate into higher gasoline costs and impact other sectors associated with transportation including airline tickets.

Mar 11, 2026

Single-Family Permits End 2025 on a Soft NoteSingle-family permitting softened over the course of 2025 and finished the year weaker than the prior year. After showing some resilience in 2024, permitting activity gradually lost momentum as elevated mortgage rates and ongoing affordability constraints weighed on buyer demand.