What to Know About the New Federal Flood Risk Management System

The Department of Housing and Urban Development released a new Federal Flood Risk Management Standard (FFRMS) in April 2024 that will affect both single-family homes and multifamily properties. Compliance will be required as of Jan. 1, 2025.

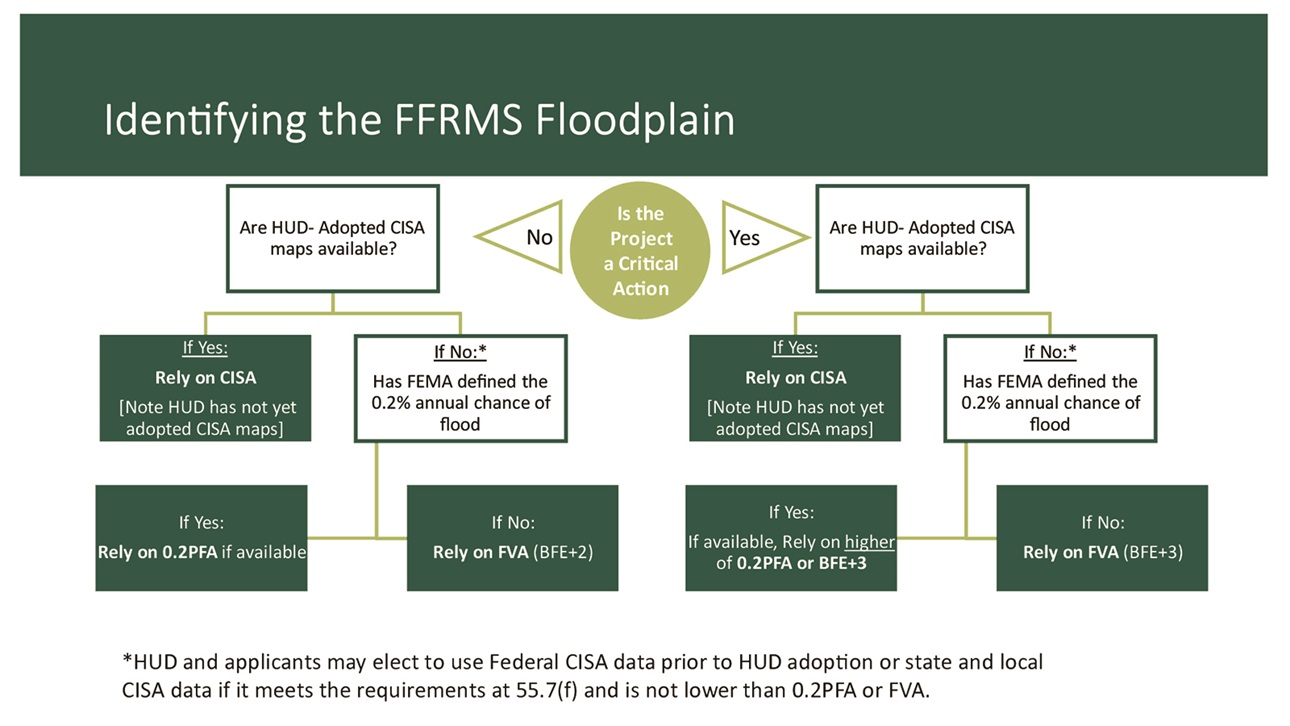

For FHA-insured or HUD-assisted multifamily properties, the new FFRMS requires a complicated, three-tiered process for determining the extent of the FFRMS floodplain, with a preference for a climate-informed science approach (CISA). The FFRMS expands the vertical and horizontal floodplain boundaries beyond the special flood hazard area (100-year floodplains). The rule requires more stringent elevation and flood proofing requirements of properties where federal funds are used to develop or provide financing for new construction within the now defined FFRMS floodplain. It also applies to substantial improvement to structures financed through HUD grants, subsidy programs and applicable multifamily programs.

Key points of interest for single-family builders and developers:

- Compliance with new elevation requirements will be required for single-family new construction where building permit applications are submitted on or after Jan. 1, 2025.

- HUD will require single-family homes located in a 100-year floodplain to be elevated 2 feet above base flood elevation to qualify for FHA mortgage insurance.

- The final rule also includes expanded notification requirements for owners, buyers and developers.

Key points of interest for multifamily builders and developers:

- Compliance with the procedures for the FFRMS floodplain management and protection of wetlands is required for FHA-insured and HUD-assisted apartment properties no later than Jan. 1, 2025.

- For HUD-assisted, HUD-acquired and HUD-insured rental properties, new and renewal leases are required to include acknowledgements signed by residents indicating that they have been advised that the property is in a floodplain and flood insurance is available for their personal property, among other information.

- HUD assured borrowers that FHA multifamily mortgage insurance applications submitted Oct. 1, 2024, could be processed under the floodplain regulations that preceded HUD’s FFRMS requirements.

NAHB will continue to monitor this requirement and provide any updates on nahb.org.

Latest from NAHBNow

Mar 11, 2026

Emerging Leader Grant Opens the Door to National Leadership for More MembersIs a member leader at your HBA planning to attend their first NAHB leadership meeting this spring? Encourage them to apply for the NAHB Emerging Leader Grant. Applications are due April 20.

Mar 11, 2026

Podcast: Massive Win in Battle Over Federal Energy Code MandatesOn the latest episode of NAHB’s podcast, Housing Developments, CEO Jim Tobin and COO Paul Lopez welcome VP of Legal Advocacy Tom Ward to discuss the impact of the recent court decision on the Department of Housing and Urban Development’s (HUD) and the Department of Agriculture’s (USDA) final determination to impose the 2021 International Energy Conservation Code (IECC) and the 2019 ASHRAE 90.1 standard on certain single-family and multifamily housing programs.

Latest Economic News

Mar 11, 2026

Inflation Steady Before WarAfter months of downward trend, inflation held steady at an eight-month low in February. This report does not reflect the recent surge in oil prices due to Iran conflict beginning February 28. Higher oil prices will likely translate into higher gasoline costs and impact other sectors associated with transportation including airline tickets.

Mar 11, 2026

Single-Family Permits End 2025 on a Soft NoteSingle-family permitting softened over the course of 2025 and finished the year weaker than the prior year. After showing some resilience in 2024, permitting activity gradually lost momentum as elevated mortgage rates and ongoing affordability constraints weighed on buyer demand.

Mar 10, 2026

Existing Home Sales Rose in FebruaryFollowing the sharp decline last month, existing home sales bounced back in February as housing affordability improved. Lower mortgage rates and moderating home price growth helped pull buyers back to the market. However, tight inventory will likely continue to push home prices higher if demand outpaces supply growth.