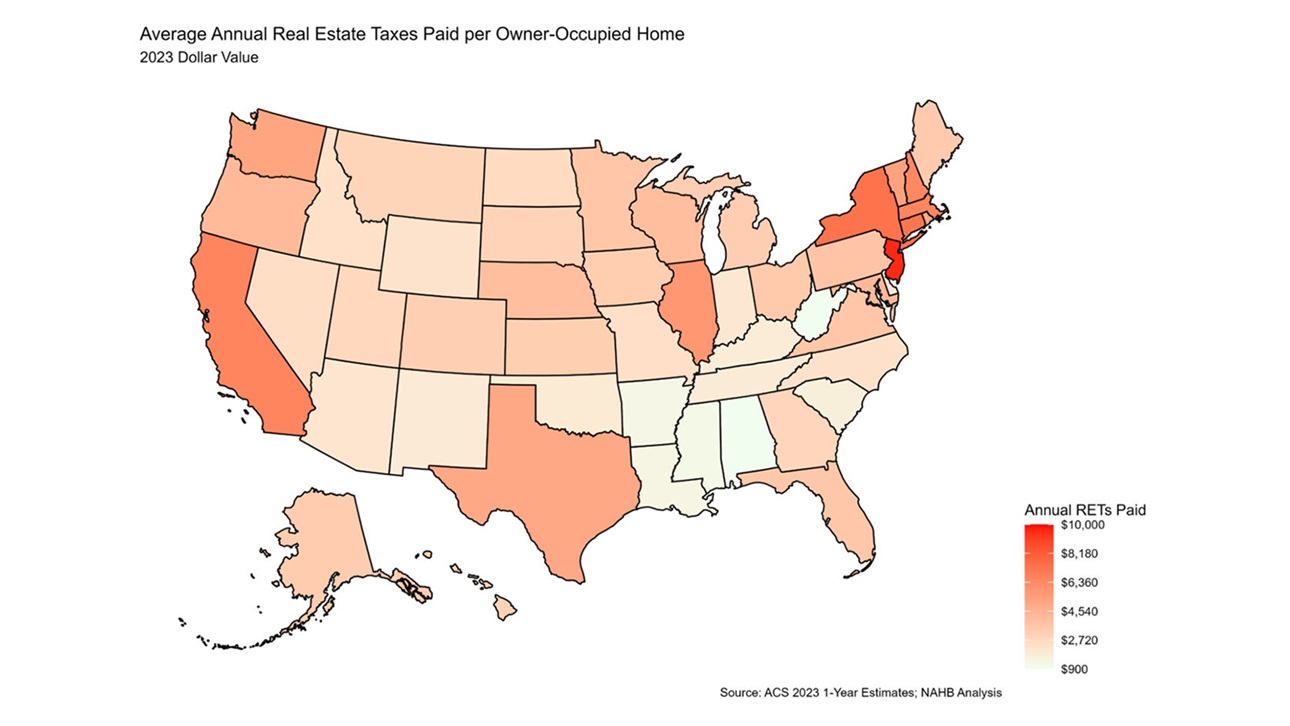

How Much Did Home Owners in Each State Pay on Property Taxes in 2023?

The average annual real estate taxes paid in 2023 across 86 million owner-occupied homes nationwide was $4,112, according to NAHB analysis of the 2023 American Community Survey. Compared to 2022, every state saw increases in the average amount of real estate taxes paid.

New Jersey continued to pay the highest real estate taxes, with an average of $9,572. That number is 30.6% higher than the second highest amount of $7,329 paid by New York home owners. The largest percentage increase was in Hawaii, up 21.1% from $2,541 to $3,078.

On the other end of the distribution, home owners in Alabama paid the lowest average amount of real estate taxes at $978. The smallest increase was in New Hampshire, up 1.1% from $6,385 to $6,453.

Average Effective Property Tax Rates

Although average annual real estate taxes paid is important, it provides an incomplete picture. Property values vary across states, which explains some, if not most, of the variation across the nation in average annual real estate taxes.

To control for property values and create a more informative state-by-state analysis, NAHB calculates the average effective property tax rate by dividing aggregate real estate taxes paid by aggregate value of owner-occupied housing within each state.

For example, the aggregate real estate taxes paid across the United States were $352.3 billion, with an aggregate value of owner-occupied real estate totaling $38.8 trillion in 2023. Using these two amounts, the average effective property tax rate nationally was $9.09 ($352.3 billion/$38.8 trillion) per $1,000 in home value. This effective rate can be expressed as a percentage of home value or as a dollar amount taxed per $1,000 of a home’s value.

Illinois had the highest effective property tax rate at $18.25 per $1,000 of home value. Hawaii had the largest increase over the year, up 18.8% from 2022.

Additionally, Hawaii had the lowest effective property tax rate at $3.18 per $1,000 of home value. Twenty states saw their effective property tax rates fall between 2022 and 2023. The largest decrease occurred in West Virginia, where it fell 6%, from $5.06 to $4.75 per $1,000.

Jesse Wade, NAHB director of tax and trade policy analysis, provides an example of how taxes can differ within each state in this Eye on Housing article.

Latest from NAHBNow

Feb 23, 2026

NAHB’s Best in American Living Awards Highlight Top Design Trends for 2026NAHB received nearly 650 application submissions for the 2025 Best in American Living™ Awards, sponsored by Smeg. The winners—66 Gold winners who took home top honors and 159 Silver winners—were announced last week at the NAHB International Builders’ Show in Orlando.

Feb 23, 2026

How Students are Turning Classrooms into Residential Construction LaunchpadsFrom showcase homes to hands-on jobsite shadowing, high school students are taking more immersive pathways toward potential careers in construction.

Latest Economic News

Feb 20, 2026

New Home Sales Close 2025 with Modest GainsNew home sales ended 2025 on a mixed but resilient note, signaling steady underlying demand despite ongoing affordability and supply constraints. The latest data released today (and delayed because of the government shutdown in fall of 2025) indicate that while month-to-month activity shows a small decline, sales remain stronger than a year ago, signaling that buyer interest in newly built homes has improved.

Feb 20, 2026

U.S. Economy Ends 2025 on a Slower NoteReal GDP growth slowed sharply in the fourth quarter of 2025 as the historic government shutdown weighed on economic activity. While consumer spending continued to drive growth, federal government spending subtracted over a full percentage point from overall growth.

Feb 19, 2026

Delinquency Rates Normalize While Credit Card and Student Loan Stress WorsensDelinquent consumer loans have steadily increased as pandemic distortions fade, returning broadly to pre-pandemic levels. According to the latest Quarterly Report on Household Debt and Credit from the Federal Reserve Bank of New York, 4.8% of outstanding household debt was delinquent at the end of 2025, 0.3 percentage points higher than the third quarter of 2025 and 1.2% higher from year-end 2024.