Housing Cost Burdens Across Congressional Districts

Buoyed by significant home equity gains and locked in by below-market mortgages rates, current home owners are in a more advantageous financial position to weather the growing affordability crisis. At the same time, renters are facing the worst affordability on record.

According to the latest 2023 American Community Survey (ACS), more than half of all renter households (23 million) spend 30% or more of their income on housing and are therefore considered burdened by housing costs. Among home owners, the share of cost-burdened households is less than a quarter (24%), which amounts to 20.6 million owner households.

As a result, congressional districts where housing markets are dominated by renters are more likely to register higher overall shares of households with cost burdens.

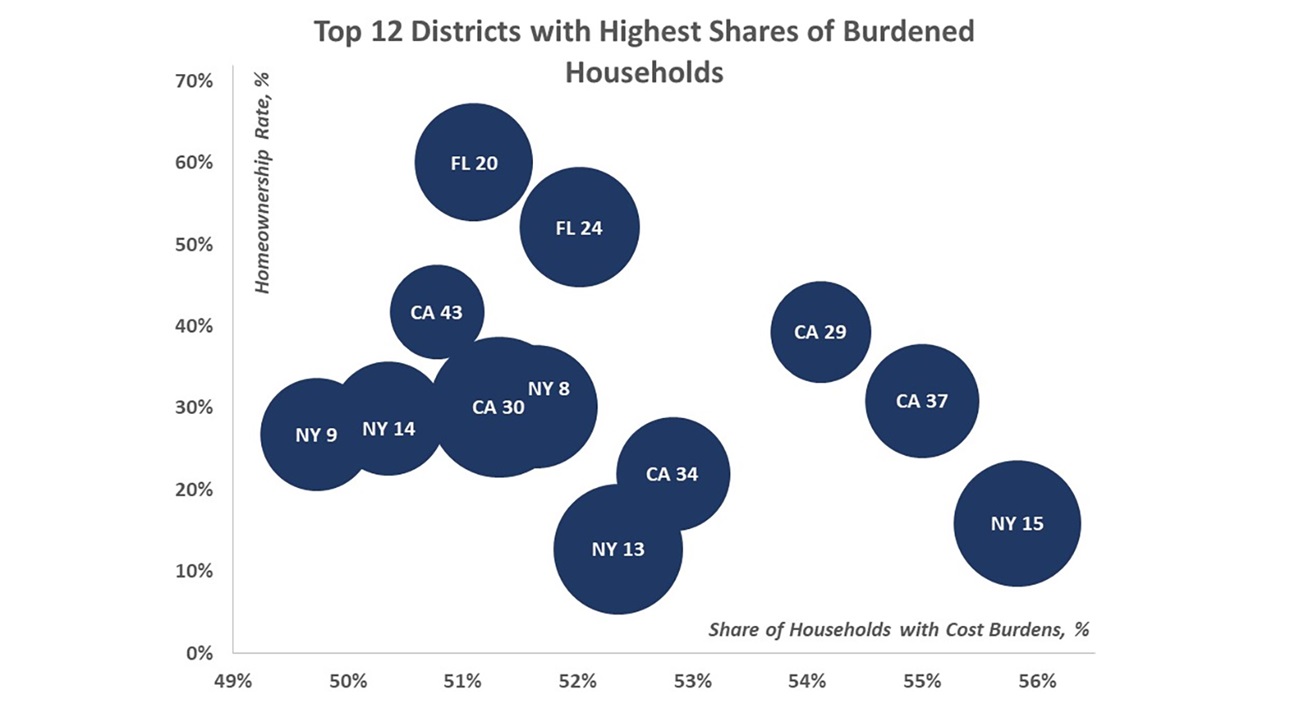

In a typical congressional district, about a third of all households — renters and owners combined — experience housing cost burdens. In contrast, in the 10 congressional districts with the highest burden rates, more than half of all households spend 30% or more of their income on housing.

The highest burden rates are found in California, New York and Florida. In New York’s 15th and 13th, 55% and 52% of households, respectively, are burdened with housing costs. The vast majority of these households are renters, as reflected by the low homeownership rates in these districts (16% and 13%, respectively).

Similarly, the remaining top 10 districts with the highest shares of burdened households have homeownership rates well below the national average of 65%. On that list, only Florida’s 20th and 24th have homeownership rates that exceed 50%.

Because congressional districts are drawn to represent roughly the same number of people, higher shares typically translate into larger counts of cost burdened households. To capture any remaining differences, the size of the bubbles in the chart correlates with the overall number of burdened households.

On the rental side, nine out of 11 worst burdened districts are in Florida. Close to two-thirds of renters in Florida’s 26th, 20th, 25th and 19th districts are burdened with housing costs. The renter burden rates are similarly high in Florida’s 28th, 21st, 24th, 13th and 23rd districts, where the shares of cost-burdened renters are between 63% and 64%. Only California’s 27th and 29th districts register slightly higher burden shares exceeding 64%.

Florida, New York and California stand out for simultaneously having congressional districts with the highest shares of cost-burdened renters and owners. Although high property taxes contribute heavily to owners’ burden in New York and California, increasing insurance premiums strain home owners’ budgets in Florida.

See this Eye on Housing post from NAHB AVP of Housing Research Natalia Siniavskaia for more details, or view more housing data for your congressional district through the U.S. Census Bureau.

Latest from NAHBNow

Feb 24, 2026

Falling Mortgage Rates Make Homeownership Possible for Millions of HouseholdsThe average interest rate on a 30-year fixed-rate mortgage fell to around 6% last week, the lowest rate borrowers have seen in close to three years. Borrowers will not only enjoy lower monthly payments at that rate, but it also makes homeownership possible for millions more.

Feb 23, 2026

Supreme Court Strikes Down Trump’s Tariffs – But Uncertainty PersistsThe Supreme Court on Feb. 20 ruled that President Trump’s attempts to use emergency powers under the International Emergency Economic Powers Act (IEEPA) was not valid. But Trump still has wide latitude in setting tariff policy and announced a new global tariff of 15%. American consumers and businesses are unsure how any new tariffs will affect them.

Latest Economic News

Feb 24, 2026

Young Adult Headship Rates in 2024: Cyclical Slip or New Equilibrium?Reversing the post-pandemic rebound, the headship rates among young adults (the share of the population heading their own households) declined in 2024, according to NAHB’s analysis of the American Community Survey (ACS) data.

Feb 23, 2026

A 25-Basis-Point Decline in the Mortgage Rate Prices-In 1.42 Million HouseholdsHousing affordability remains a critical challenge nationwide, and mortgage rates continue to play a central role in shaping homebuying power. Although rates have declined from the recent peak of about 7.6% in 2023 to around 6.01% as of February 19,2026, they remain elevated relative to typical levels in the 2010s.

Feb 20, 2026

New Home Sales Close 2025 with Modest GainsNew home sales ended 2025 on a mixed but resilient note, signaling steady underlying demand despite ongoing affordability and supply constraints. The latest data released today (and delayed because of the government shutdown in fall of 2025) indicate that while month-to-month activity shows a small decline, sales remain stronger than a year ago, signaling that buyer interest in newly built homes has improved.