Tightened Credit for Builders in Q2

During the second quarter of 2024, credit for residential Land Acquisition, Development & Construction (AD&C) continued to tighten and became even more expensive for most types of loans, according to NAHB’s survey on AD&C Financing. The survey was conducted in July and asked specifically about financing conditions in the second quarter, predating the release of some relatively weak economic data that has raised prospects for monetary policy easing.

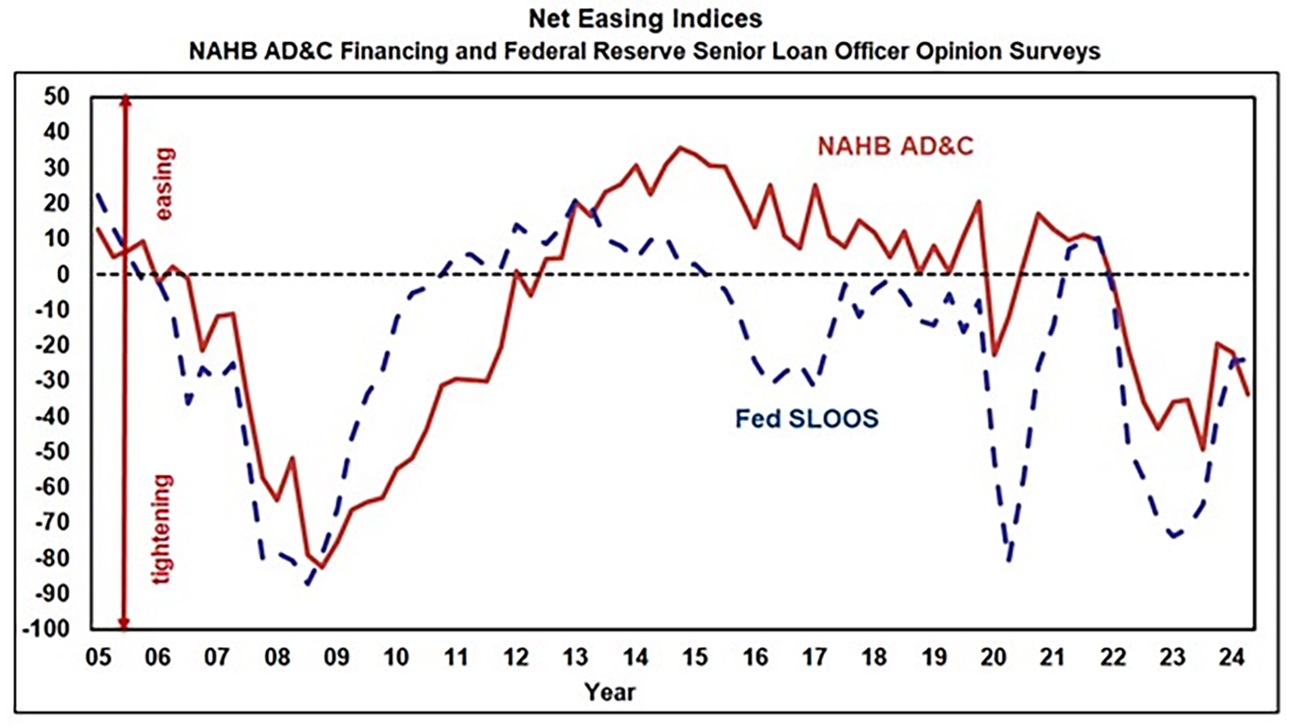

The net easing index derived from the survey posted a reading of -33.7 in the second quarter. (The negative number indicates that credit was tighter than in the previous quarter.) The comparable net easing index based on the Federal Reserve’s survey of senior loan officers posted a similar result, with a reading of -23.8 — marking the 10th consecutive quarter of borrowers and lenders both reporting tightening credit conditions.

According to the NAHB survey, the majority (85%) of respondents noted that lenders were tightening in the second quarter by:

- Reducing the amount they are willing to lend, and

- Lowering the loan-to-value (or loan-to-cost) ratio.

Half of respondents also reported tightening by increasing documentation, increasing the interest rate, and requiring personal guarantees or other collateral unrelated to the project.

As credit becomes less available, it also tends to become more expensive. In the second quarter, the contract interest rate increased on all four categories of AD&C loans tracked in the NAHB survey:

- 8.40% in 2024 Q1 to 9.28% on loans for land acquisition,

- 8.07% to 9.05% on loans for land development,

- 8.24% to 8.98% on loans for speculative single-family construction, and

- 8.38% to 8.55% on loans for pre-sold single-family construction.

Paul Emrath, NAHB vice president for survey and housing policy, provides further insights in this Eye on Housing post.

Latest from NAHBNow

Mar 09, 2026

Watch Video Highlights from the Leadership Meetings at the 2026 IBSNAHB members who were unable to join us in Orlando, Fla., this February for the leadership meetings at the 2026 International Builders' Show can watch some of the highlights on nahb.org.

Mar 06, 2026

NAHB Court Win Vacates HUD 2021 IECC MandateA recent court decision in a case brought by NAHB and 15 states pertaining to federal energy code mandates is a major win for our members, housing affordability and common-sense regulations.

Latest Economic News

Mar 06, 2026

U.S. Economy Loses 92,000 Jobs in FebruaryThe U.S. labor market weakened in February, as payroll employment declined and the unemployment rate rose to 4.4%. The cooling labor market could place the Federal Reserve in a challenging position as policymakers weigh slower job growth against inflation pressures from rising oil prices.

Mar 05, 2026

Builders Identify Key Long-Term Forces Shaping Housing Demand and Industry HealthHome builders are keenly aware of the complex long-term outlook ahead for the home building industry. A recent NAHB/Wells Fargo HMI survey asked builders to assess the impact of 14 major trends and forces on the health of the industry and housing demand over the next 10 years.

Mar 05, 2026

Affordability Posts Mild Gains in Second Half of 2025 but Crisis ContinuesThough new and existing homes remain largely unaffordable, the needle moved slightly in the right direction in the second half of 2025, according to the latest data from the National Association of Home Builders (NAHB)/Wells Fargo Cost of Housing Index (CHI).