Share of Homes Built on Slabs Surges

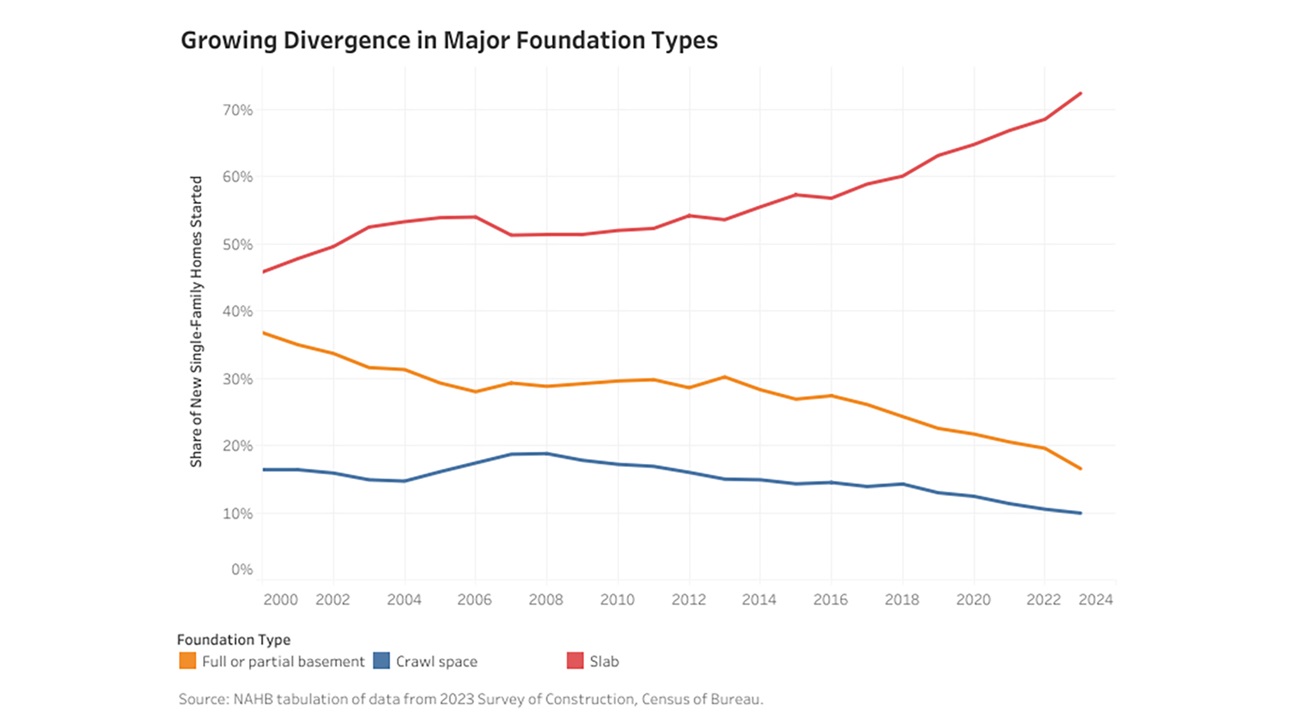

The majority of new single-family homes started in 2023 were built on slab foundations, according to NAHB analysis of the Survey of Construction (SOC). The share of new homes built on slabs has risen steadily from 45.8% in 2000 to 72.4% in 2023. The largest increase occurred from 2022 to 2023, with a jump of 3.9 percentage points, compared to an average increase of 1.93 percentage points over the previous five years.

Conversely, the share of homes with full or partial basements decreased by 3 percentage points from 19.6% in 2022 to 16.6% 2023. Only 9.9% of new single-family homes were built with crawl spaces.

In colder areas where building codes require foundations to be built below the frost line, most homes are constructed with full or partial basements. In the northern divisions, full or partial basement foundations provide additional finished floor areas at a marginal increase of construction cost. The divisions with a majority share of full or partial basements in new homes are West North Central (63.9%), followed by New England (62.1%), Middle Atlantic (48.1%) and East North Central (48%).

In warmer climates where slab foundations are preferred for their cost-effectiveness, new homes with slab foundations are most commonly found in the West South Central (96.9%), Pacific (86.5%), South Atlantic (83.3%) and Mountain (52.9%) divisions.

NAHB Economist Catherine Koh provides more, including interactive graphics, in this Eye on Housing post.

Latest from NAHBNow

Feb 24, 2026

Falling Mortgage Rates Make Homeownership Possible for Millions of HouseholdsThe average interest rate on a 30-year fixed-rate mortgage fell to around 6% last week, the lowest rate borrowers have seen in close to three years. Borrowers will not only enjoy lower monthly payments at that rate, but it also makes homeownership possible for millions more.

Feb 23, 2026

Supreme Court Strikes Down Trump’s Tariffs – But Uncertainty PersistsThe Supreme Court on Feb. 20 ruled that President Trump’s attempts to use emergency powers under the International Emergency Economic Powers Act (IEEPA) was not valid. But Trump still has wide latitude in setting tariff policy and announced a new global tariff of 15%. American consumers and businesses are unsure how any new tariffs will affect them.

Latest Economic News

Feb 24, 2026

Young Adult Headship Rates in 2024: Cyclical Slip or New Equilibrium?Reversing the post-pandemic rebound, the headship rates among young adults (the share of the population heading their own households) declined in 2024, according to NAHB’s analysis of the American Community Survey (ACS) data.

Feb 23, 2026

A 25-Basis-Point Decline in the Mortgage Rate Prices-In 1.42 Million HouseholdsHousing affordability remains a critical challenge nationwide, and mortgage rates continue to play a central role in shaping homebuying power. Although rates have declined from the recent peak of about 7.6% in 2023 to around 6.01% as of February 19,2026, they remain elevated relative to typical levels in the 2010s.

Feb 20, 2026

New Home Sales Close 2025 with Modest GainsNew home sales ended 2025 on a mixed but resilient note, signaling steady underlying demand despite ongoing affordability and supply constraints. The latest data released today (and delayed because of the government shutdown in fall of 2025) indicate that while month-to-month activity shows a small decline, sales remain stronger than a year ago, signaling that buyer interest in newly built homes has improved.