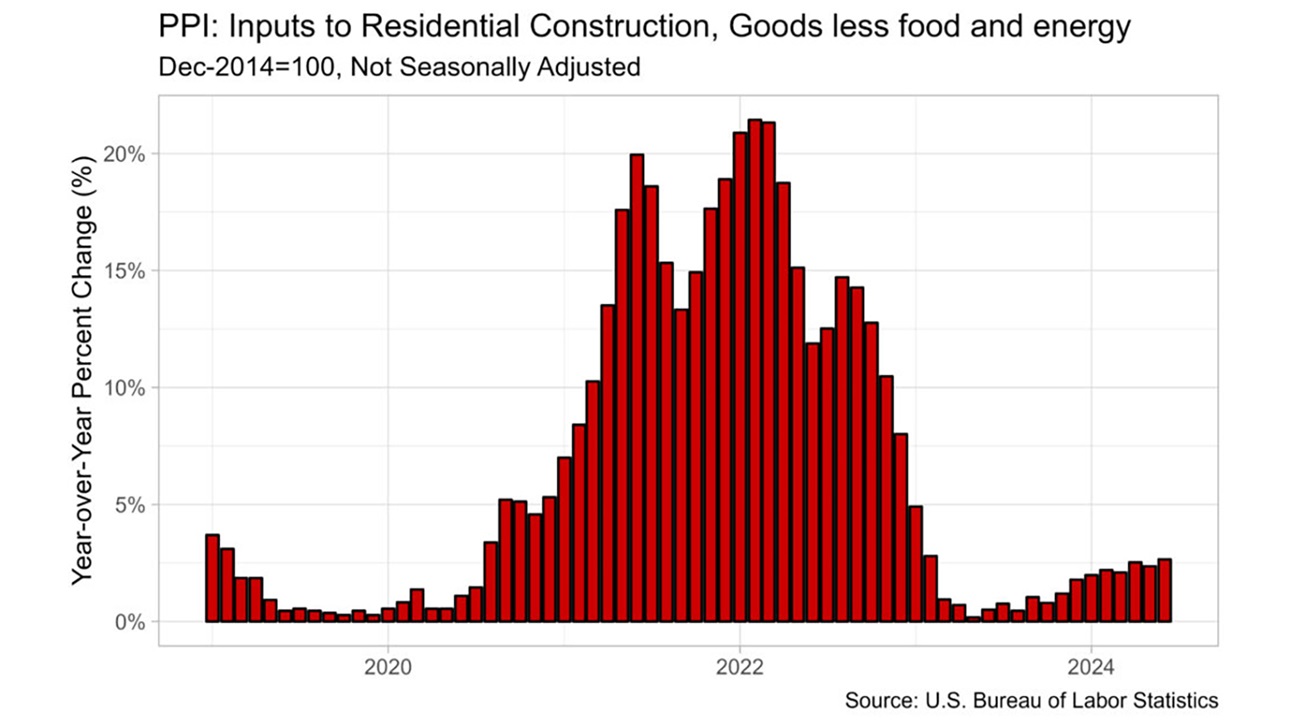

June Marks Highest Yearly Increase in Building Material Prices Since February 2023

Inputs to residential construction (goods less food and energy) — which represent building materials used in residential construction — rose 0.19% in June, according to the most recent producer price index (PPI) report from the U.S. Bureau of Labor Statistics. In May, the index fell 0.26% after rising 0.22% in April.

Year-over-year growth has continued to climb this year — June’s increase of 2.65% was the highest since February 2023. Despite overall inflation declining, prices for inputs to residential construction have accelerated since the start of the year, leaving home builders to continue to deal with higher building material prices.

Specific increases include:

- Softwood lumber rose 3.41% in June, after falling 5% in May.

- Gypsum building materials were unchanged for the second consecutive month but were up 2.32% over the year.

- Ready-mix concrete rose 0.45% in June after rising a revised reading of 0.26% in May.

Meanwhile, steel mill products fell 1.18% in June after rising 0.54% in May, and copper fell 2.67% in June, the first monthly decline since February of this year.

Jesse Wade, NAHB director of tax and trade policy analysis, provides more details in this Eye on Housing post.

Latest from NAHBNow

Mar 12, 2026

Statement from NAHB Chairman Bill Owens on Passage of Senate Housing BillNAHB Chairman Bill Owens issued the following statement after the Senate passed the 21st Century ROAD to Housing Act.

Mar 12, 2026

Single-Family Starts Remain Soft in January on Affordability ConcernsOverall housing starts increased 7.2% in January to a seasonally adjusted annual rate of 1.49 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

Latest Economic News

Mar 12, 2026

Single-Family Starts Remain Soft in January on Affordability ConcernsElevated construction costs and constrained affordability conditions led to a reduction in single-family housing starts in January.

Mar 11, 2026

Inflation Steady Before WarAfter months of downward trend, inflation held steady at an eight-month low in February. This report does not reflect the recent surge in oil prices due to Iran conflict beginning February 28. Higher oil prices will likely translate into higher gasoline costs and impact other sectors associated with transportation including airline tickets.

Mar 11, 2026

Single-Family Permits End 2025 on a Soft NoteSingle-family permitting softened over the course of 2025 and finished the year weaker than the prior year. After showing some resilience in 2024, permitting activity gradually lost momentum as elevated mortgage rates and ongoing affordability constraints weighed on buyer demand.