Who Are Today’s Home Buyers?

Using the 2021 American Housing Survey (AHS), NAHB investigated the characteristics of recent home buyers — defined as households who purchased homes in the two years preceding the date the 2021 AHS was conducted — in a new special study. According to this criterion, roughly 10.2 million households recently bought and moved to a new home.

The study focuses on two important groups of home buyers: Those who bought a brand-new home (new home buyers) and those who purchased a home for the first time (first-time home buyers).

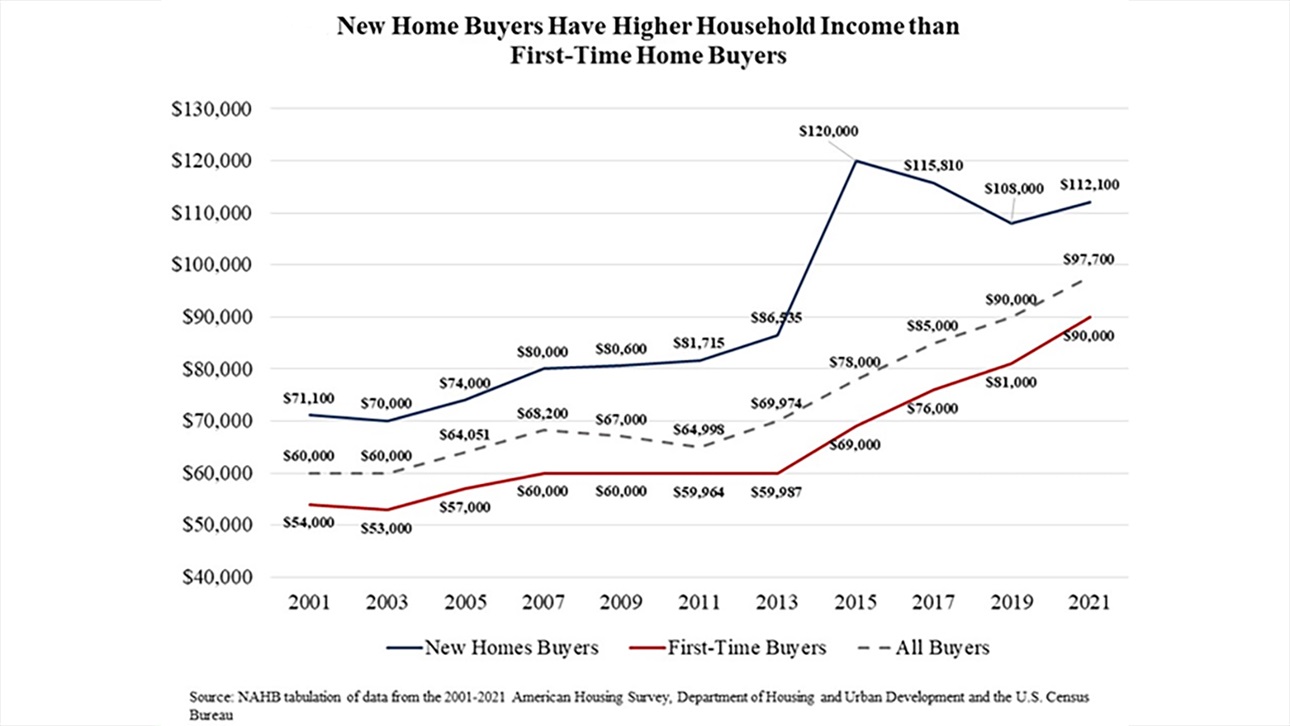

Income

In the 2021 AHS, the median household income for all recent home buyers was $97,700. Median household income among all home buyers grew 13% from $60,000 in 2001 to $68,000 in 2007 and then fell 4% to $64,998 in 2011. After the Great Recession, household income accelerated, jumping by around 50% from $64,998 in 2011 to $97,700 in 2021. Not surprisingly, new home buyers consistently show higher median income than first-time home buyers ($112,100 vs $90,000 in 2021).

Age

According to the 2021 AHS, the median age of all home buyers was 41. The median age of first-time buyers was 33, while the median age of new home buyers was 45.

Household size may also play a factor, as a growing family is one of the reasons of home purchases. The average household size for recent home buyers was 2.70 in the 2021 AHS. It declined from 2001 to 2011 (2.84 to 2.61), then grew steadily afterwards.

Meanwhile, the average household size among non-moving homeowners was 2.57 in 2021.

Financing

More than half of recent buyers put no more than 20% down on the homes they purchased. Around 18% of all buyers purchased a home without a down payment in 2021, 50% had a down payment of 0 to 20%, and only 16% put more than 20% down.

Among all recent home buyers, first-time buyers had relatively smaller down payments. Approximately 82% of first-time home buyers put no more than 20% down, including 18% with zero down payment. In comparison, only 63% of buyers purchased new homes with no more than 20% down.

The median value of the homes purchased was $318,185 overall in the 2021 AHS. The median value of new homes was $429,205, and the median value of homes purchased by a first-time buyer was $271,445.

Types of Homes Purchased

In the 2021 AHS, 91.2%, of new homes purchased were single-family detached, while 6.9% were single-family attached and 2% were multifamily condos. Meanwhile, 83.8% of first-time home buyers purchased a single-family detached home. The remaining 16.2% are split evenly between single-family attached homes and multifamily condos.

The full report, which includes additional details and charts showing trends over time, is available on nahb.org.

Latest from NAHBNow

Feb 13, 2026

Existing Home Sales in January Plunged to Lowest Level Since 2024Existing home sales in January fell to lowest level since August 2024 as tight inventory continued to push home prices higher and winter weather weighed on sales activity.

Feb 12, 2026

The Biggest Challenges Expected by Home Builders in 2026According to the latest NAHB/Wells Fargo Housing Market Index, 84% of home builders felt the most significant challenge builders faced in 2025 was high interest rates and 65% anticipate interest rates will remain a problem in 2026.

Latest Economic News

Feb 13, 2026

Inflation Eased in JanuaryInflation eased to an eight-month low in January, confirming a continued downward trend. Though most Consumer Price Index (CPI) components have resolved shutdown-related distortions from last fall, the shelter index will remain affected through April due to the imputation method used for housing costs. The shelter index is likely to show larger increases in the coming months.

Feb 12, 2026

Existing Home Sales Retreat Amid Low InventoryExisting home sales fell in January to a more than two-year low after December’s strong rebound, as tight inventory continued to push home prices higher and winter storms weighed on activity. Despite mortgage rates trending lower and wage growth outpacing price gains, limited resale supply kept many buyers on the sidelines.

Feb 12, 2026

Residential Building Worker Wages Slow in 2025 Amid Cooling Housing ActivityWage growth for residential building workers moderated notably in 2025, reflecting a broader cooling in housing activity and construction labor demand. According to the latest data from the U.S. Bureau of Labor Statistics (BLS), both nominal and real wages remained modest during the fourth quarter, signaling a shift from the rapid post-pandemic expansion to a slower-growth phase.