Strong Job Gains in September

Job growth remained solid in September as the Federal Reserve fights against inflation. In fact, the recent jobs data have been stronger than most economists expected and is a reminder that GDP growth for the third quarter will be very strong and inflation risks will persist.

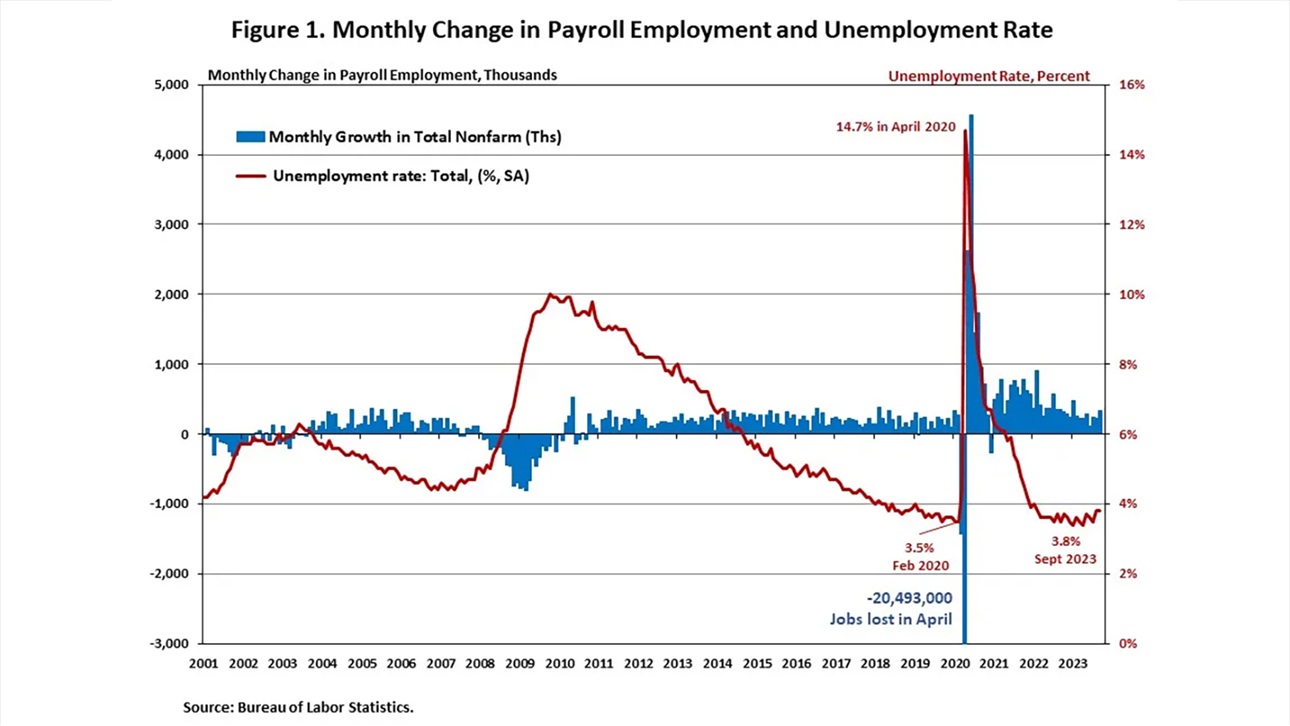

Despite restrictive monetary policy, nearly 5.9 million jobs have been created since March 2022, when the Fed enacted the first interest rate hike of this cycle. In the first nine months of 2023, nearly 2.3 million jobs were created, and monthly employment growth averaged 260,000 per month, following the average monthly growth of 399,000 in 2022.

Total nonfarm payroll employment increased by 336,000 in September, following a gain of 227,000 in August, as reported in the Employment Situation Summary. The estimates for the previous two months were revised higher. The unemployment rate remained at 3.8% in September.

However, wage growth slowed. In September, wages grew at a 4.2% year-over-year growth rate, down 1.8 percentage points from the highest gain of 5.7% in February 2022. Slowing wage growth was the one positive data point for those hoping for slowing inflation in the labor market report.

Meanwhile, the labor force participation rate — the proportion of the population either looking for a job or already holding a job — remained unchanged at 62.8%. Moreover, the labor force participation rate for people who aged between 25 and 54 was unchanged at 83.5%. While the overall labor force participation rate is still below its pre-pandemic levels at the beginning of 2020, the rate for people who aged between 25 and 54 exceeds the pre-pandemic level of 83.1%.

Jing Fu, Ph.D., NAHB director of forecasting and analysis, provides a breakdown by industry sector in this Eye on Housing post.

Latest from NAHBNow

Feb 19, 2026

2026 Builders’ Show Spotlights Innovation, Demand for Home BuildingNearly 75,000 registrants filled the exhibit halls of the Orange County Convention Center as the National Association of Home Builders (NAHB) hosted the NAHB International Builders’ Show® (IBS), the largest annual light construction show in the world, Feb. 17-19.

Feb 19, 2026

NAHB Announces 2025 Best in American Living Awards WinnersThe National Association of Home Builders (NAHB) announced the winners of the 2025 Best in American Living™ Awards (BALA) during the NAHB International Builders’ Show in Orlando. The awards are sponsored by Smeg.

Latest Economic News

Feb 19, 2026

Delinquency Rates Normalize While Credit Card and Student Loan Stress WorsensDelinquent consumer loans have steadily increased as pandemic distortions fade, returning broadly to pre-pandemic levels. According to the latest Quarterly Report on Household Debt and Credit from the Federal Reserve Bank of New York, 4.8% of outstanding household debt was delinquent at the end of 2025, 0.3 percentage points higher than the third quarter of 2025 and 1.2% higher from year-end 2024.

Feb 18, 2026

Overall Housing Starts Inch Lower in 2025Despite a strong finish in December, single-family home building dipped in 2025 as persistent affordability challenges continued to weigh on the market.

Feb 18, 2026

How Housing Affordability Conditions Vary Across States and Metro AreasThe NAHB 2026 priced-out estimates show that the housing affordability challenge is widespread across the country. In 39 states and the District of Columbia, over 65% of households are priced out of the median-priced new home market. This indicates a significant disconnect between higher new home prices, elevated mortgage rates, and household incomes.