U.S. Lot Values Trail Inflation in Most Regions

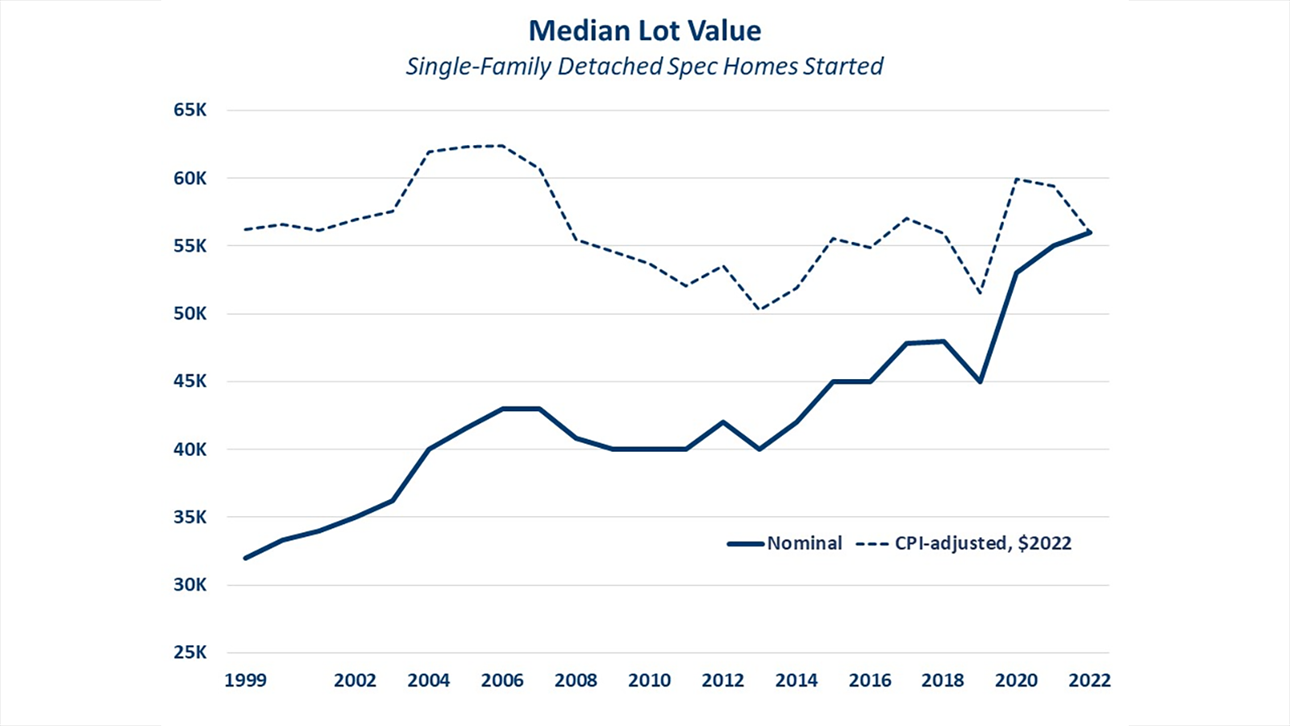

Lot values for single-family detached (SFD) spec homes continued to rise in 2022, according to NAHB’s analysis of the Census Bureau’s Survey of Construction (SOC) data, with the U.S. median lot value at $56,000 for SFD for-sale homes started in 2022. Even though lot values continued to rise across most regions, the overall U.S. inflation averaged 8% in 2022 and outpaced lot appreciation in all divisions except the East North Central and South Atlantic.

Nationally, when adjusted for inflation, median lot values remain below the record levels of the housing boom of 2005-06 when the median lot value was $43,000, which is equivalent to about $62,400 when converted into inflation-adjusted 2022 dollars.

But there is a substantial variation in lot values and appreciation across the U.S. regions:

- New England: $180,000

- Pacific: $150,000

- Mountain: $81,000

- East North Central: $71,000

- Middle Atlantic: $66,000

- West North Central: $65,000

- West South Central: $58,000

- South Atlantic: $50,000

- East South Central: $45,000

New England has had the most expensive lots for decades, and its median lot price is more than triple the 2022 national median. New England is known for strict local zoning regulations that often require very low densities. In fact, the median lot size for SFD spec homes started in New England in 2022 was 2.5 times the national median. Therefore, it is not surprising that typical SFD spec homes in New England are built on some of the largest and most expensive lots in the nation.

The Pacific division — which set a new nominal record for the division in 2022 — has the smallest lots. As a result, the Pacific division lots are the most expensive in the nation in terms of per-acre costs.

The East North Central and South Atlantic divisions registered the strongest growth in lot values in the nation. Median lot values in East North Central surged 42% to a new high of $71,000, a division record even when adjusted for inflation. The South Atlantic division recorded a 19% rise in lot values and set a new nominal record. But despite the fast appreciation, the South Atlantic remains home to some of the less expensive spec home lots in the nation.

Other more economical divisions include the neighboring East South Central division, whose lots are significantly larger than the national median and reflect the lowest per-acre cost, and West South Central, which appreciated at a more moderate pace in 2022 after recording some of the fastest lot value appreciation in recent years.

Natalia Siniavskaia, NAHB assistant vice president for housing policy research, provides more details and analysis in this Eye on Housing post.

Latest from NAHBNow

Feb 19, 2026

NAHB Honors the Industry’s Top Achievements at The NationalsThe National Association of Home Builders (NAHB) honored top achievements in residential real estate sales, marketing, individual achievement and global excellence at The Nationals℠ Awards Gala (sponsored by Chase) during the NAHB International Builders’ Show in Orlando. Awards were also presented for the 55+ housing, NAHB Honors and Global Innovation award categories.

Feb 18, 2026

Impact of Affordability Challenges and Demographic Shifts on Housing Trends in 2026Housing affordability has declined significantly in recent years. The deterioration in price-to-income ratio has been a key factor, as home prices have risen 53% since 2019, while median household income has risen only 24%. This has notably decreased the share of first-time home buyers in the market, which dropped to 21% in 2025 from 44% in 1981. Over that same time frame, the median age for first-time buyers reached a record high of 40 in 2025 from 29 in 1981.

Latest Economic News

Feb 18, 2026

Overall Housing Starts Inch Lower in 2025Despite a strong finish in December, single-family home building dipped in 2025 as persistent affordability challenges continued to weigh on the market.

Feb 18, 2026

How Housing Affordability Conditions Vary Across States and Metro AreasThe NAHB 2026 priced-out estimates show that the housing affordability challenge is widespread across the country. In 39 states and the District of Columbia, over 65% of households are priced out of the median-priced new home market. This indicates a significant disconnect between higher new home prices, elevated mortgage rates, and household incomes.

Feb 17, 2026

Builder Sentiment Edges Lower on Affordability ConcernsBuilder confidence in the market for newly built single-family homes fell one point to 36 in February, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).