Top States for Remodeling Applications in 2021

The residential remodeling market has grown rapidly in the past few years, mainly fueled by changes in housing and lifestyle decisions during the pandemic period. Solid existing home sales, high incomes, high home price appreciation and an aging housing stock supported strong remodeling activity in 2021.

According to National Income and Product Accounts (NIPA), expenditures for residential home improvements soared 13% to $328 billion in 2021, from $289 billion in 2020. This marks the largest gain since 1993.

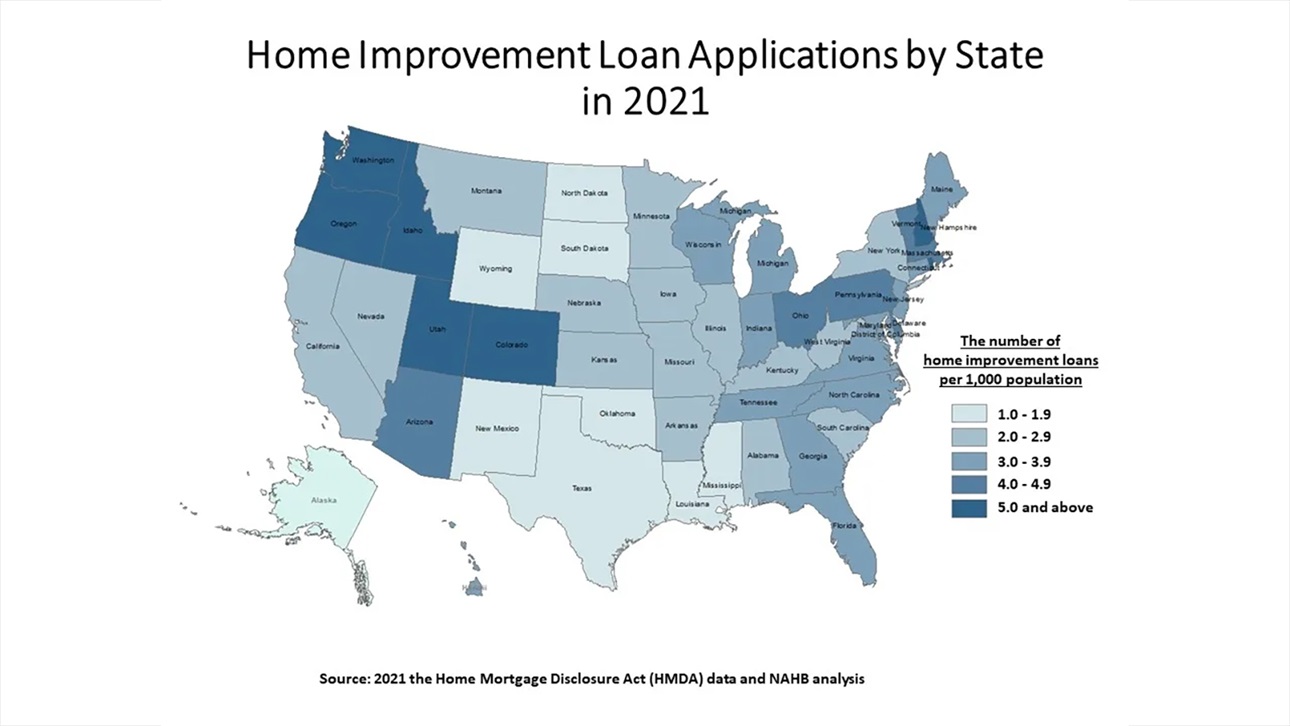

Remodeling activity has varied across geographic locations. The 2021 Home Mortgage Disclosure Act (HMDA) data, published by Consumer Financial Protection Bureau (CFPB), covers detailed information on residential mortgage lending in 2021. NAHB’s analysis of the 2021 HMDA data provides insight into remodeling activity across the United States.

The analysis finds that home improvement loan applications are relatively more common in the Pacific and Mountain divisions.

California had the highest total number of home improvement loan applications in 2021, with 109,856 applications, followed by Florida (82,341 applications). Wyoming and Alaska had the lowest total numbers of home improvement loan applications, which were below 1,000.

In terms of home improvement loan applications per 1,000 population, the top five states were:

- Utah

- Idaho

- Rhode Island

- New Hampshire

- Colorado

California, the most populous state of the United States, reported 2.8 applications per 1,000 population, which is lower than the national average rate of 3.3 applications per 1,000 population.

For more details, including county-specific data, read the full post on Eye on Housing.

Latest from NAHBNow

Jan 02, 2026

Trump Delays Higher Tariffs on Furniture, Kitchen Cabinets for One YearPresident Trump has announced he will be rolling back higher tariffs on furniture, kitchen cabinets and vanities that were set to go into effect on Jan. 1, 2026, until Jan. 1, 2027.

Jan 02, 2026

FHA’s MMI Fund Capital Ratio Remained Solid in Fiscal Year 2025The capital reserve ratio for the Federal Housing Administration’s Mutual Mortgage Insurance Fund ended the fiscal year at 11.47% — unchanged from the capital ratio for fiscal year 2024 and well above the congressionally mandated 2% capital ratio.

Latest Economic News

Dec 22, 2025

State-Level Employment Situation: September 2025In September 2025, nonfarm payroll employment was largely unchanged across states on a monthly basis, with a limited number of states seeing statistically significant increases or decreases. This reflects generally stable job counts across states despite broader labor market fluctuations. The data were impacted by collection delays due to the federal government shutdown.

Dec 19, 2025

Existing Home Sales Edge Higher in NovemberExisting home sales rose for the third consecutive month in November as lower mortgage rates continued to boost home sales, according to the National Association of Realtors (NAR). However, the increase remained modest as mortgage rates still stayed above 6% while down from recent highs. The weakening job market also weighed on buyer activity.

Dec 18, 2025

Lumber Capacity Lower Midway Through 2025Sawmill production has remained essentially flat over the past two years, according to the Federal Reserve G.17 Industrial Production report. This most recent data release contained an annual revision, which resulted in higher estimates for both production and capacity in U.S. sawmills.