Construction Job Openings Rise in May, But Long-Run Trend is Declining

The count of open, unfilled jobs for the overall economy moved lower in May, falling to 9.8 million. While ongoing tight labor market conditions have likely confirmed one to two more Fed rate hikes through the start of the fall, the JOLTS survey is another data point indicating an ongoing, but gradual, cooling of macro conditions.

The count of open jobs was 11.4 million a year ago in May 2022. The count of total job openings will continue to fall in 2023 as the labor market softens and unemployment rises. From a monetary policy perspective, ideally the count of open, unfilled positions slows to the 8 million range in the coming quarters as the Fed’s actions cool inflation.

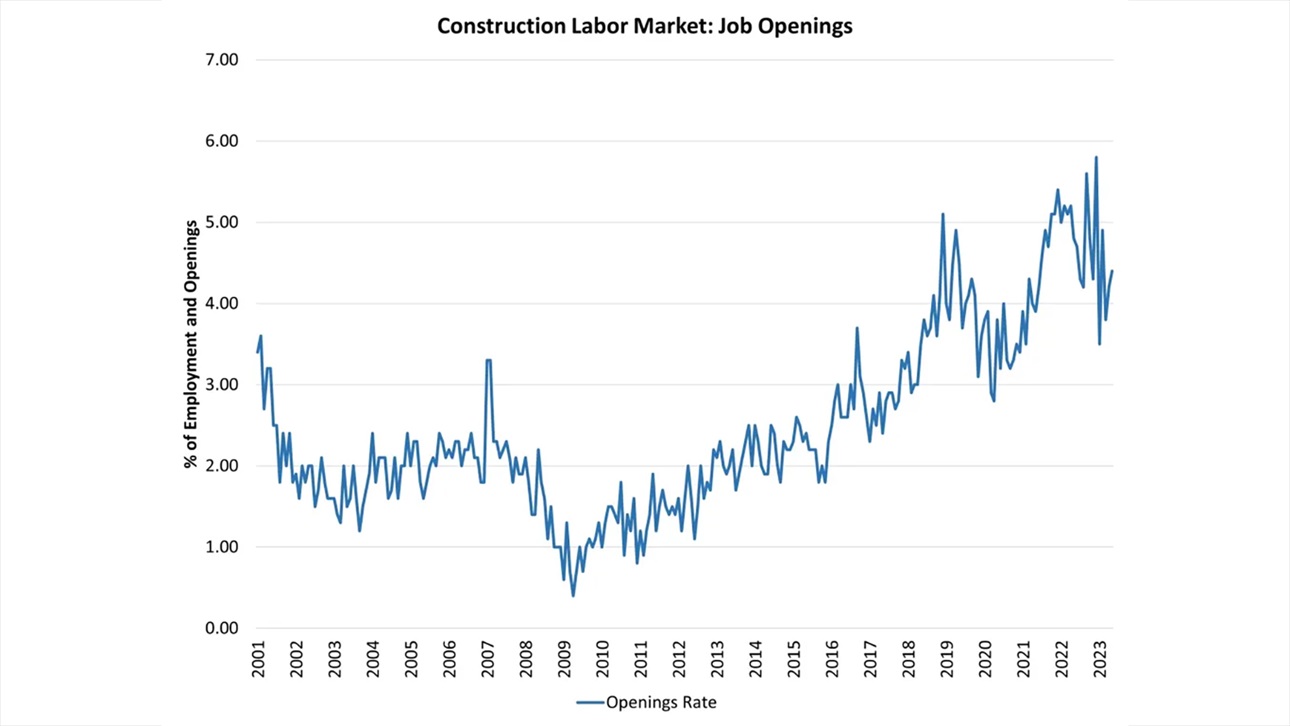

The construction labor market saw an increase for job openings in May, although this occurred off of downwardly revised April estimates. The count of open construction jobs increased from a revised reading of 347,000 in April to 366,000 in May. These data come after a data series high of 488,000 in December 2022. The overall trend is one of cooling for open construction sector jobs as the housing market slows and backlog is reduced, with a notable uptick in month-to-month volatility since late last year.

The construction job openings rate increased from 4.2% in April to 4.4% in May. The recent trend of these estimates points to the construction labor market having peaked in 2022 and is now entering a stop-start cooling stage as the housing market adjusts to higher interest rates.

NAHB Chief Economist Robert Dietz provides more analysis in this Eye on Housing post.

Latest from NAHBNow

Mar 03, 2026

Delaware Home Builders Score Permitting VictoryMembers sustained advocacy efforts helped shape an executive order designed to fast-track development and improve housing affordability in the state.

Mar 02, 2026

Top 10 States for NGBS Green Certification Activity in 2025Texas once again tops multifamily certification, and Florida took the top spot for most single-family certifications for the second consecutive year.

Latest Economic News

Feb 27, 2026

Gains for Student Housing Construction in the Last Quarter of 2025Private fixed investment for student dormitories was up 1.5% in the last quarter of 2025, reaching a seasonally adjusted annual rate (SAAR) of $3.9 billion. This gain followed three consecutive quarterly declines before rebounding in the final two quarters of the year.

Feb 27, 2026

Price Growth for Building Materials Slows to Start the YearResidential building material prices rose at a slower rate in January, according to the latest Producer Price Index release from the Bureau of Labor Statistics. This was the first decline in the rate of price growth since April of last year. Metal products continue to experience price increases, while specific wood products are showing declines in prices.

Feb 26, 2026

Home Improvement Loan Applications Moderate as Borrower Profile Gradually AgesHome improvement activity has remained elevated in the post-pandemic period, but both the volume of loan applications and the age profile of borrowers have shifted in notable ways. Data from the Home Mortgage Disclosure Act (HMDA), analyzed by NAHB, show that total home improvement loan applications have eased from their recent post-pandemic peak, and the distribution of borrowers across age groups has gradually tilted older.