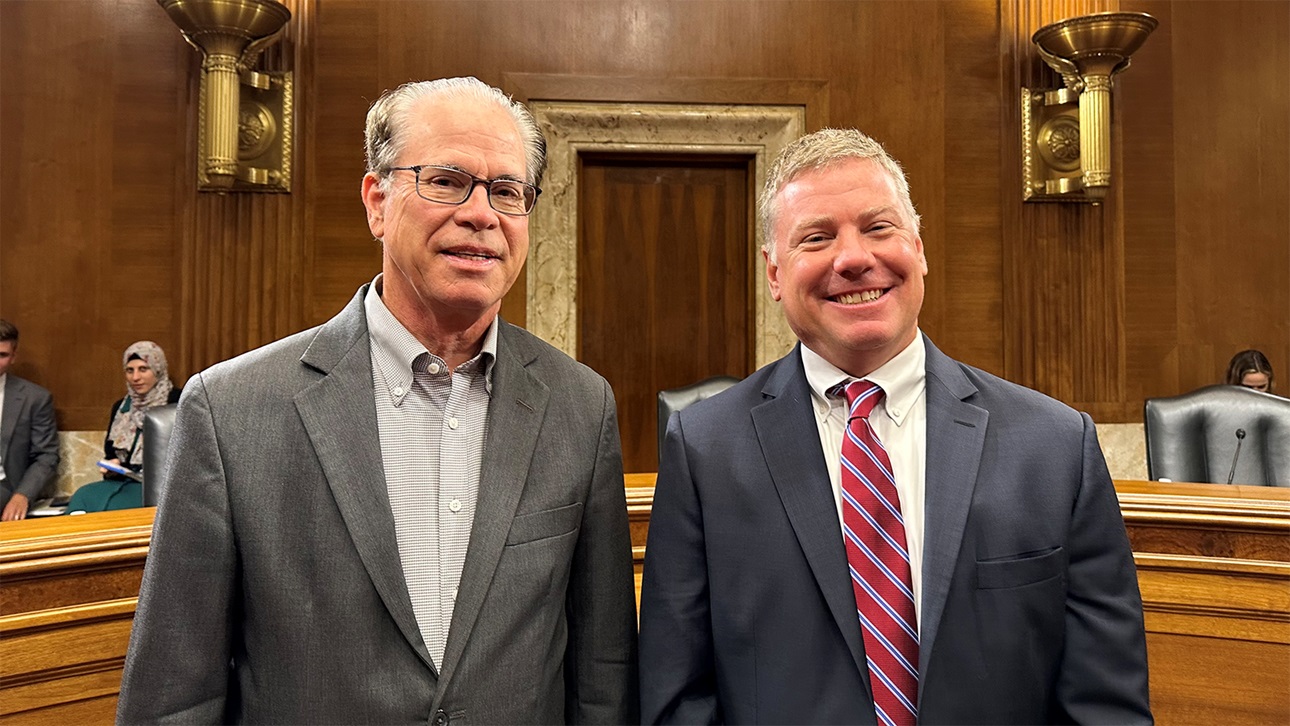

Indiana HBA Leader Testifies Before Congress on Affordability Issues

At the invitation of Sen. Mike Braun (R-Ind.), the ranking member of the Senate Special Committee on Aging, Wajda testified before the panel on a hearing focusing on housing issues.

“The fact is homeownership is unattainable for many across Indiana — including two-earner households — due to tight supply, inflationary pressures, regulatory costs and rising mortgage rates,” said Wajda. “This is why we must look at reducing the cost of housing at all levels.”

Wajda cited NAHB research to lawmakers that nearly 25% of the costs of a new home nationwide can be attributed to regulations.

“Regulations come in many forms and can be imposed by various levels of government,” he said. “At the local level, jurisdictions may charge permit, hook-up, and impact fees and establish development and construction standards that either directly increase costs to builders and developers, or cause delays that translate to higher costs. State and federal governments may be involved in this process directly or indirectly. For example, restrictive building codes add thousands of dollars to the cost of a house, making it that much more difficult to qualify for a mortgage.”

To improve housing affordability, Wajda told lawmakers that all regulations should be examined for their impact on housing affordability.

“Communities can reduce the cost of producing new housing by eliminating fee increases, assisting with infrastructure costs and allowing for higher density housing where the market demands it,” said Wajda. “Our aging population may want to age in place or age in community. Creativity and options to allow this must be explored and implemented.”

Latest from NAHBNow

Mar 02, 2026

NAHB Student Competition Success Shows Residential Construction Future is BrightFor two days at the International Builders' Show, aspiring land developers, designers and project managers from NAHB Student Chapters across the country presented thorough building proposals and fielded tough questions from an audience of construction company executives.

Feb 27, 2026

Senate Bill Would Exclude Building Materials from TariffsNAHB worked with Sens. Jacky Rosen (D-Nev.) and Chris Coons (D-Del.) to introduce legislation that would address the housing affordability crisis by creating an exemption process for building materials from tariffs.

Latest Economic News

Feb 27, 2026

Gains for Student Housing Construction in the Last Quarter of 2025Private fixed investment for student dormitories was up 1.5% in the last quarter of 2025, reaching a seasonally adjusted annual rate (SAAR) of $3.9 billion. This gain followed three consecutive quarterly declines before rebounding in the final two quarters of the year.

Feb 27, 2026

Price Growth for Building Materials Slows to Start the YearResidential building material prices rose at a slower rate in January, according to the latest Producer Price Index release from the Bureau of Labor Statistics. This was the first decline in the rate of price growth since April of last year. Metal products continue to experience price increases, while specific wood products are showing declines in prices.

Feb 26, 2026

Home Improvement Loan Applications Moderate as Borrower Profile Gradually AgesHome improvement activity has remained elevated in the post-pandemic period, but both the volume of loan applications and the age profile of borrowers have shifted in notable ways. Data from the Home Mortgage Disclosure Act (HMDA), analyzed by NAHB, show that total home improvement loan applications have eased from their recent post-pandemic peak, and the distribution of borrowers across age groups has gradually tilted older.