Pyramid Illustrates Housing Affordability Crisis

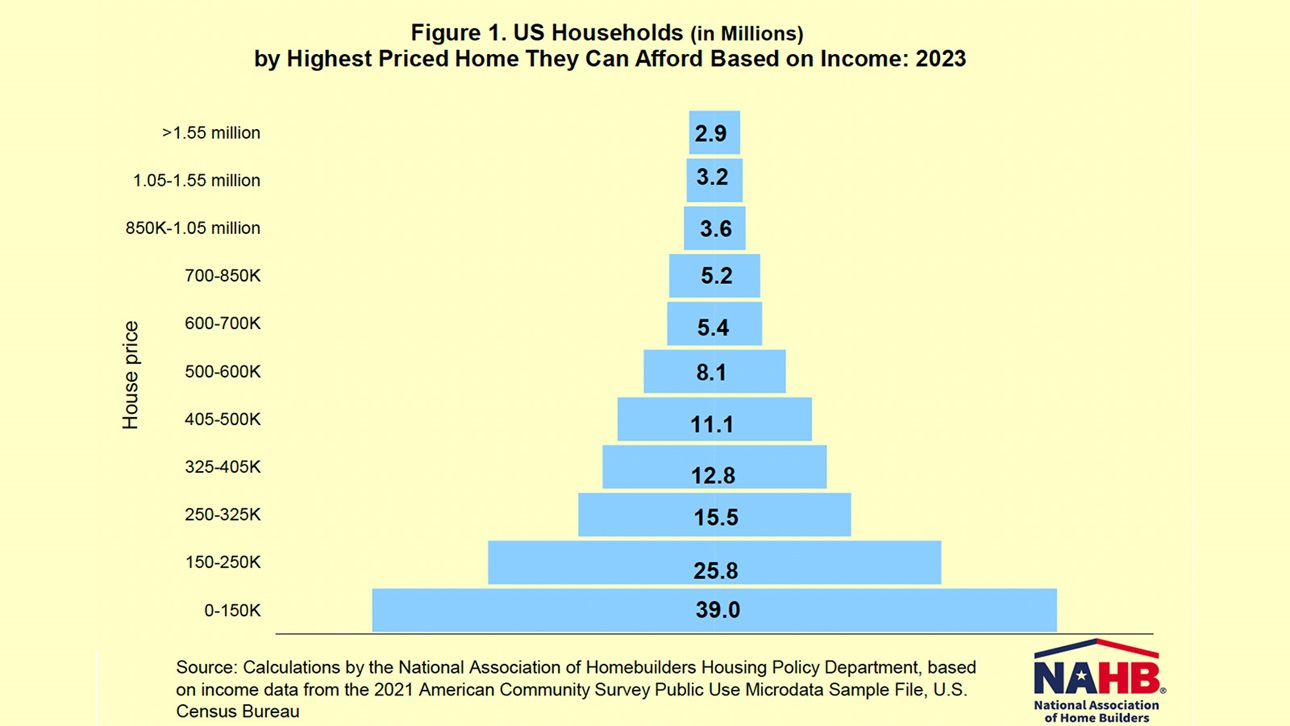

NAHB has updated its "housing affordability pyramid" for 2023, and the latest data show that 64.8 million households out of a total of 132.5 million are unable to afford a $250,000 home.

The pyramid is based on conventional underwriting standards that assume the cost of a mortgage, property taxes and property insurance should not exceed 28% of household income. Based on this methodology, NAHB economists have calculated how many households have enough income to afford a home at various price thresholds.

At the base of the pyramid are 39 million U.S. households with insufficient incomes to be able to afford a $150,000 home.

The pyramid's second step consists of 25.8 million with enough income to afford a top price somewhere between $150,000 and $250,000. Adding up the bottom two rungs shows that there are 64.8 million households who cannot afford a $250,000 home.

The nationwide median price of a new single-family home is $425,786, meaning half of all new homes sold in the U.S. cost more than this figure and half cost less. A total of 96.5 million households — roughly 73% of all U.S. households — cannot afford this median-priced new home.

This helps put affordability concerns into perspective and goes a long way toward explaining why housing affordability now stands at a more than 10-year low.

The top of the pyramid shows that 9.7 million households have enough income to buy a $850,000 home (adding up the top three rungs), and 2.9 million even have enough for a home priced at $1.55 million. But market analysts should never focus on this to the exclusion of the wider steps that support the pyramid's base.

On March 2, NAHB released its new Priced-Out Estimates for 2023, which shows that a $1,000 increase in the price of a median-priced new home will price 140,436 U.S. households out of the market for the home.

Prospective home buyers also are adversely affected when interest rates rise. NAHB's priced-out estimates show that 1.28 million households are priced out of the market for a new median priced home at $425,786 when interest rates rise a quarter-point from 6.25% to 6.5%. An increase from 6.5% to 6.75% prices approximately 1.29 million households out of the market.

Latest from NAHBNow

Feb 27, 2026

New Army Corps Initiative Will Streamline Permitting ProcessThe Army Corps of Engineers on Feb. 23 announced a new initiative called “Building Infrastructure, Not Paperwork” that the agency said will “shorten permitting timelines, and reduce or eliminate extraneous regulations and paperwork.”

Feb 27, 2026

Labor Department Proposes New FLSA Independent Contractor RuleThe U.S. Department of Labor (DOL) today published notice of its intent to revise its regulations that distinguish covered employees from exempt independent contractors for enforcement purposes under the Fair Labor Standards Act (FLSA), Family and Medical Leave Act (FMLA) and other laws.

Latest Economic News

Feb 27, 2026

Gains for Student Housing Construction in the Last Quarter of 2025Private fixed investment for student dormitories was up 1.5% in the last quarter of 2025, reaching a seasonally adjusted annual rate (SAAR) of $3.9 billion. This gain followed three consecutive quarterly declines before rebounding in the final two quarters of the year.

Feb 27, 2026

Price Growth for Building Materials Slows to Start the YearResidential building material prices rose at a slower rate in January, according to the latest Producer Price Index release from the Bureau of Labor Statistics. This was the first decline in the rate of price growth since April of last year. Metal products continue to experience price increases, while specific wood products are showing declines in prices.

Feb 26, 2026

Home Improvement Loan Applications Moderate as Borrower Profile Gradually AgesHome improvement activity has remained elevated in the post-pandemic period, but both the volume of loan applications and the age profile of borrowers have shifted in notable ways. Data from the Home Mortgage Disclosure Act (HMDA), analyzed by NAHB, show that total home improvement loan applications have eased from their recent post-pandemic peak, and the distribution of borrowers across age groups has gradually tilted older.