State Property Taxes Continue to Highlight Differences Across the Country

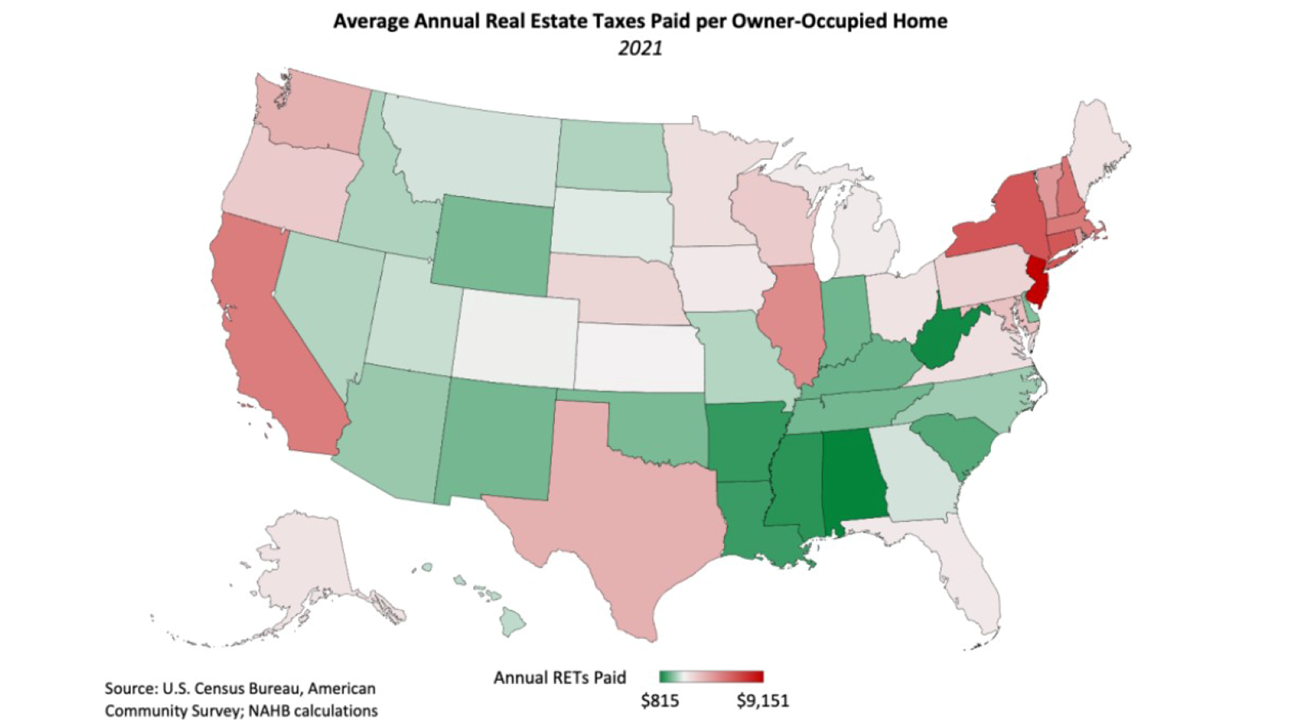

Real estate taxes vary widely across states, both in terms of annual taxes paid as well as effective tax rates. In 2021, the difference between average real estate taxes (RETs) paid by New Jersey and Alabama home owners was $8,336. New Jersey continued its perennial distinction as having the highest average real estate tax bill per home owner ($9,151) as well as the highest effective tax rate (2.02%).

Hawaii (0.28%) and Alabama ($815) were at the other end of the spectrum, boasting the lowest average effective tax rate and annual real estate tax bill, respectively. The difference between the highest-taxed state (New Jersey) and lowest (Alabama) grew by $362 between 2019 and 2021, more than double the growth between 2017 and 2019 ($170).

The overall distribution has remained roughly unchanged since 2019, as the composition of the top ten remained the same except Washington replaced Texas as the state with the 10th-highest average real estate tax bills. The map below illustrates the concentration of high average property tax bills in the Northeast. In contrast, southern states (excluding Texas) boast some of the lowest real estate tax bills for their resident homeowners.

NAHB economist David Logan looks at the national picture and provides further analysis in this Eye on Housing blog post.

Latest from NAHBNow

Mar 02, 2026

NAHB Student Competition Success Shows Residential Construction Future is BrightFor two days at the International Builders' Show, aspiring land developers, designers and project managers from NAHB Student Chapters across the country presented thorough building proposals and fielded tough questions from an audience of construction company executives.

Feb 27, 2026

Senate Bill Would Exclude Building Materials from TariffsNAHB worked with Sens. Jacky Rosen (D-Nev.) and Chris Coons (D-Del.) to introduce legislation that would address the housing affordability crisis by creating an exemption process for building materials from tariffs.

Latest Economic News

Feb 27, 2026

Gains for Student Housing Construction in the Last Quarter of 2025Private fixed investment for student dormitories was up 1.5% in the last quarter of 2025, reaching a seasonally adjusted annual rate (SAAR) of $3.9 billion. This gain followed three consecutive quarterly declines before rebounding in the final two quarters of the year.

Feb 27, 2026

Price Growth for Building Materials Slows to Start the YearResidential building material prices rose at a slower rate in January, according to the latest Producer Price Index release from the Bureau of Labor Statistics. This was the first decline in the rate of price growth since April of last year. Metal products continue to experience price increases, while specific wood products are showing declines in prices.

Feb 26, 2026

Home Improvement Loan Applications Moderate as Borrower Profile Gradually AgesHome improvement activity has remained elevated in the post-pandemic period, but both the volume of loan applications and the age profile of borrowers have shifted in notable ways. Data from the Home Mortgage Disclosure Act (HMDA), analyzed by NAHB, show that total home improvement loan applications have eased from their recent post-pandemic peak, and the distribution of borrowers across age groups has gradually tilted older.