All-Cash New Home Sales Outnumber FHA-Backed for the First Time Since 2007

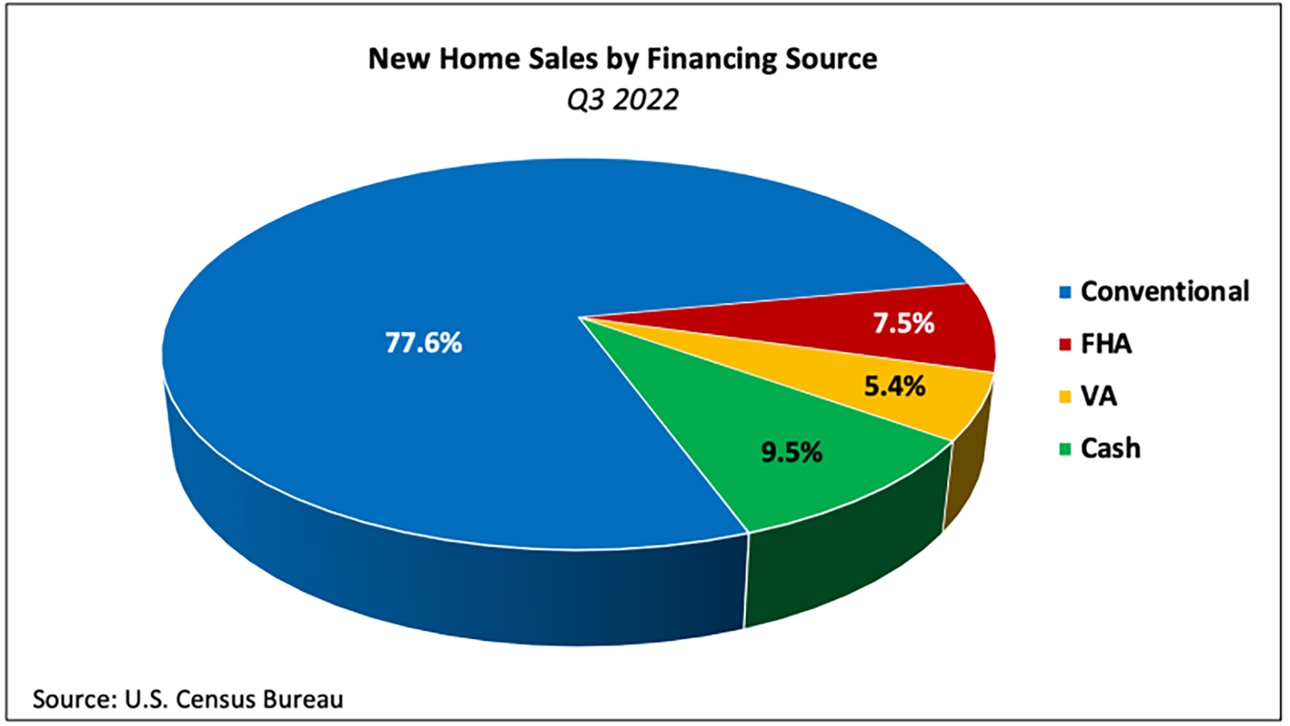

NAHB analysis of the most recent Quarterly Sales by Price and Financing published by the U.S. Census Bureau reveals that more homes were bought in the third quarter of 2022 using cash than were financed through FHA loans for the first time since 2007.

The share of cash purchases has climbed each of the past three quarters to reach a 20-year high of 9.5% (14,000 sales).

In contrast, new home sales financed through the Federal Housing Administration (FHA) numbered 11,000 and accounted for 7.5% of total sales in the third quarter of 2022 — the smallest share since the fourth quarter of 2007. The share has dropped by nearly two-thirds since the spring of 2020.

Other sources of financing include:

- Conventional loans, which financed 77.6% of new home sales in the third quarter. This represents a 1.2 percentage point quarter-over-quarter increase, and the share has risen each of the prior seven quarters.

- VA-backed sales, the share of which declined 0.8 percentage point to 5.4% in the third quarter but is 0.8 percentage points higher than the share one year prior.

In the second quarter, the national median sales price of a new home was $454,900. The median new home price has increased 5% in 2022, but there is a large variance by type of financing. The price of a new home purchased with cash has increased 27.3% since the first quarter of 2022, while the price of an FHA-backed sale has fallen 7.6%.

Split by types of financing, the median prices of new homes were:

- Conventional loans — $503,200

- FHA loans — $340,300

- VA loans — $432,200

- Cash — $494,200

Although cash sales typically make up a small portion of new home sales, they constitute a larger share of existing home sales. According to estimates from the National Association of REALTORS, 22% of existing home transactions were all-cash sales in September 2022, down from 24% in August 2022 and 23% in September 2021.

David Logan, director of tax and trade policy analysis, details key factors contributing to these dynamics in this Eye on Housing post.

Latest from NAHBNow

Jan 14, 2026

Applications for 2026 Leadership Grants and Scholarships Now OpenNAHB is invested in professional development opportunities for its members and providing exposure to NAHB leadership meetings to help foster future leaders for the home building industry. Applications are now open for select leadership grants and scholarships for qualified members to capitalize on these opportunities.

Jan 13, 2026

Podcast: Home Builders and Buyers Unsettled as 2026 BeginsOn the latest episode of NAHB’s podcast, Housing Developments, CEO Jim Tobin and COO Paul Lopez kick off the first podcast of 2026 looking at the state of housing, the political environment heading into a midterm year, and how builders and buyers are attempting to navigate the current market.

Latest Economic News

Jan 14, 2026

Building Material Price Growth Remains Elevated in NovemberResidential building material prices continued to experience elevated growth, according to the latest Producer Price Index release from the Bureau of Labor Statistics. Price growth has been above 3.0% since June this year, despite continued weakness in the new residential construction market.

Jan 13, 2026

New Home Sales Rise Year-Over-Year as Prices StabilizeThe new home sector has played an increasingly important role in meeting housing demand as resale inventory remains constrained in many regions. The latest data released today (and delayed because of the government shutdown in fall of 2025) indicate that new single-family home sales continue to reflect a stabilizing market after a period of heightened volatility.

Jan 13, 2026

Inflation Steady in DecemberInflation held steady in December, matching November’s reading, according to the Bureau of Labor Statistics (BLS) latest report. This December report was the first report to include a month-to-month figure since the government shutdown.