Interest in New Homes on the Rise

The share of adults planning a home purchase within a year rose from 13% in the first half of 2022 to 15% in the third quarter. The marginal increase suggests that the prospect of higher mortgage rates in the near term may be leading a small segment of consumers to consider the purchase of a home sooner rather than later.

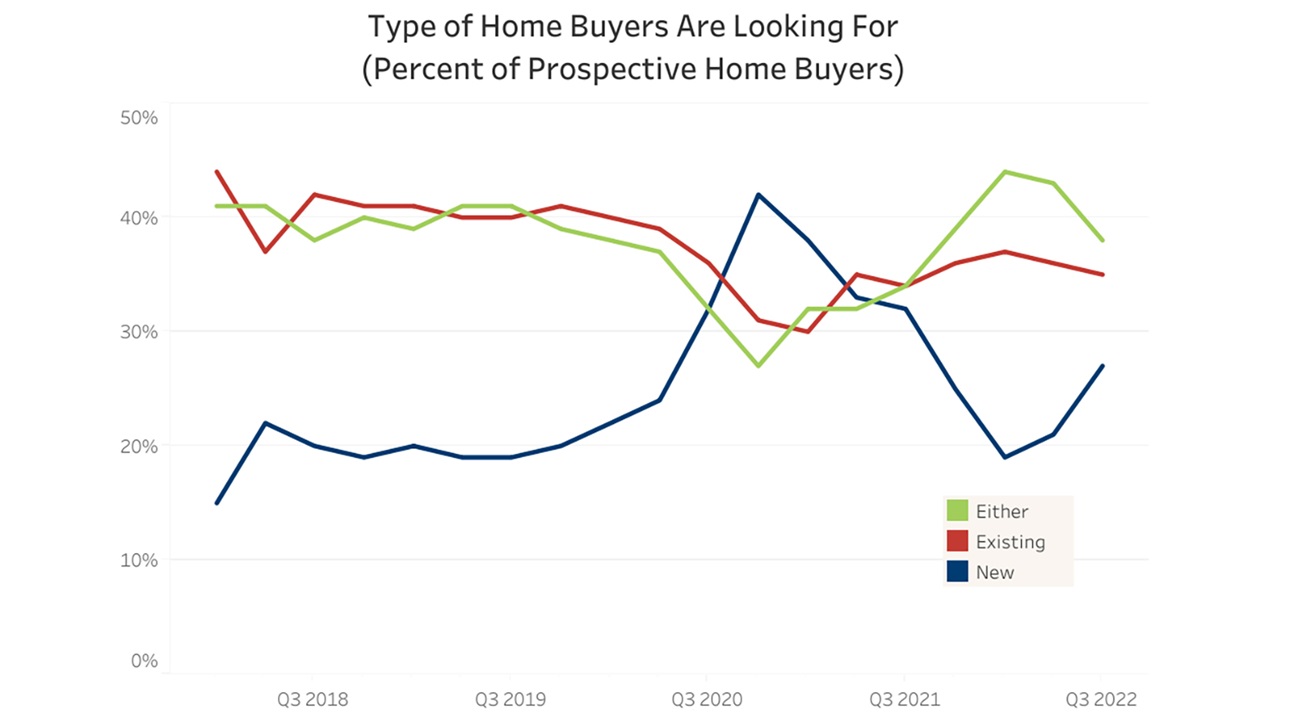

New homes in particular may be of interest. After bottoming out at 19% in the first quarter of 2022, the popularity of new homes continues to rebound, as the share of buyers looking for new construction rose to 21% and 27% in the second and third quarters of the year, respectively, according to NAHB’s Housing Trends Report. This interest is nationwide: The share of prospective buyers looking to purchase a new home rose in all four regions.

A possible factor behind this trend is that the inventory of new homes for sale is 25% higher than a year ago, while the supply of existing homes on the market is unchanged.

Rose Quint, NAHB Assistant Vice President for Survey Research, provides more information — including interactive graphs — in these Eye on Housing posts:

Latest from NAHBNow

Feb 27, 2026

Labor Department Proposes New FLSA Independent Contractor RuleThe U.S. Department of Labor (DOL) today published notice of its intent to revise its regulations that distinguish covered employees from exempt independent contractors for enforcement purposes under the Fair Labor Standards Act (FLSA), Family and Medical Leave Act (FMLA) and other laws.

Feb 27, 2026

NAHB Invests $190,000 to Advance Local Pro-Housing PoliciesNAHB's State and Local Government Affairs Committee recently approved $190,000 through the State and Local Issues Fund (SLIF) to help HBAs overcome barriers to housing affordability.

Latest Economic News

Feb 27, 2026

Price Growth for Building Materials Slows to Start the YearResidential building material prices rose at a slower rate in January, according to the latest Producer Price Index release from the Bureau of Labor Statistics. This was the first decline in the rate of price growth since April of last year. Metal products continue to experience price increases, while specific wood products are showing declines in prices.

Feb 26, 2026

Home Improvement Loan Applications Moderate as Borrower Profile Gradually AgesHome improvement activity has remained elevated in the post-pandemic period, but both the volume of loan applications and the age profile of borrowers have shifted in notable ways. Data from the Home Mortgage Disclosure Act (HMDA), analyzed by NAHB, show that total home improvement loan applications have eased from their recent post-pandemic peak, and the distribution of borrowers across age groups has gradually tilted older.

Feb 26, 2026

Affordability Pyramid Shows Over Half of U.S. Households Cannot Buy a $300,000 HomeNAHB recently released its 2026 Priced-Out Analysis, highlighting the housing affordability challenge. While previous posts discussed the impacts of rising home prices and interest rates on affordability, this post focuses on the related U.S. housing affordability pyramid.