Overall Building Material Prices Down in September, but Concrete Keeps Rising

Led by a decline in softwood lumber and steel mill prices, overall building material prices fell in September with the notable exception of ready-mix concrete, which continues to grow at a rapid clip. And while gypsum prices edged lower last month, they are up more than 20% over the past year.

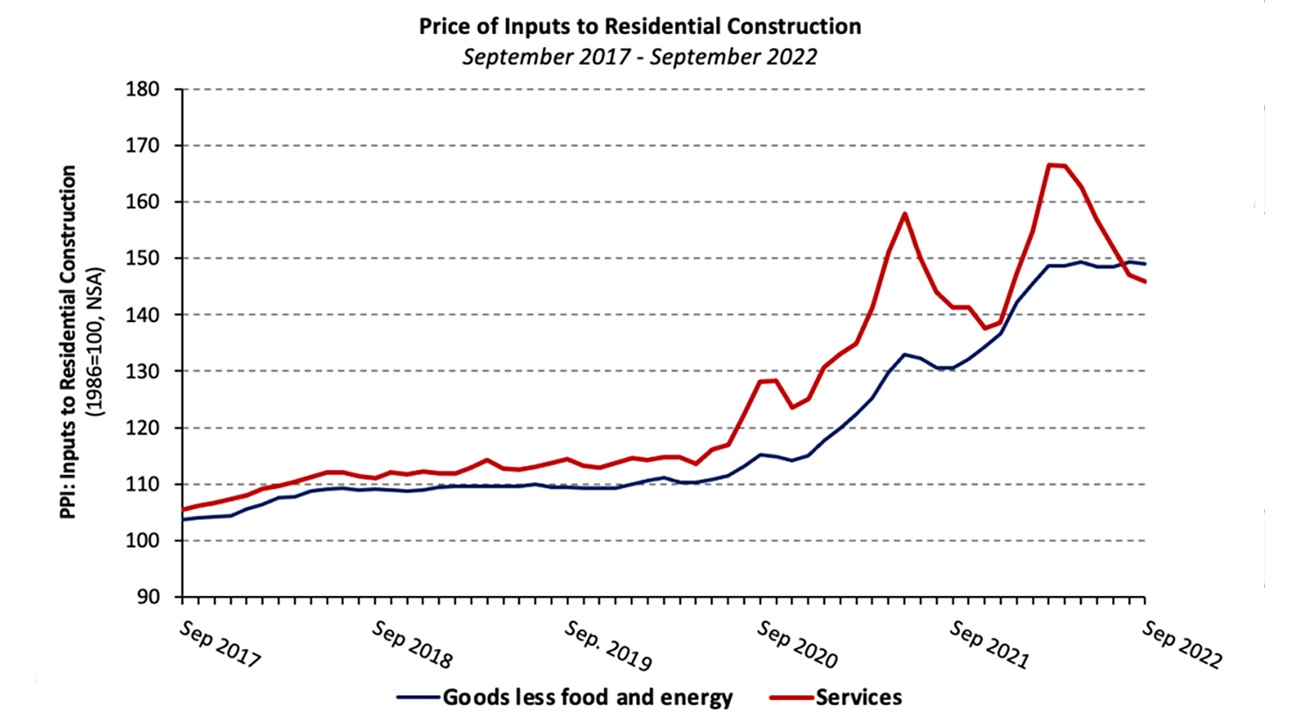

In tandem with a slowing housing market and economy, the prices of building materials decreased 0.3% in September (not seasonally adjusted) according to the latest Producer Price Index (PPI) report. The PPI for goods inputs to residential construction, including energy, declined for the third consecutive month in September (-0.1%).

Prices have fallen 2.3% since June, the largest three-month drop since April 2020. However, these modest price declines have occurred when material prices were already at extremely elevated rates.

And while lumber and steel prices have trended down in recent months, the prices of ready-mix concrete and gypsum building materials have continued their climb dating back to early 2021.

Not only is gypsum a major component of drywall, it is also a critical ingredient to the Portland cement used to manufacture ready-mix concrete. High demand for cement combined with lower imports of aggregate due to a large quarry shutdown in Mexico have spread thin the supply of domestically produced ready-mix concrete as well as gypsum. As drywall and cement are used in many applications outside of residential construction, prices have increased even as single-family construction has cooled.

Softwood Lumber

The PPI for softwood lumber (seasonally adjusted) declined 2.9% in September following a 5.2% drop in August. Softwood lumber prices are 14.5% higher than they were a year ago but have fallen 39.6% since March. The index remains 41.9% above pre-pandemic levels.

Steel Mill Products

Steel mill products prices decreased 6.7% in September and have fallen 16.1% over the past four months. The index is at its lowest level since June 2021, but prices of steel mill products are nearly double their pre-pandemic levels, on average.

Ready-Mix Concrete

The PPI for ready-mix concrete (RMC) increased 1.4% in September — its sixth consecutive increase — and has risen 11.6% over the past year. The index has climbed 8.9% year-to-date, the largest September YTD increase in the series’ 34-year history.

The monthly increase in the national data was primarily driven by a 2.6% price increase in the South region and partially offset by a 0.7% decline in the Northeast. Prices were flat in the Midwest and edged 0.3% higher in the West.

Gypsum Building Materials

The PPI for gypsum building materials edged 0.2% lower in September — just the second monthly decrease in two years. Prices have increased 20.2% over the past year and are up 46.0% since January 2020.

NAHB senior economist David Logan provides more analysis in this Eye on Housing blog post.

Latest from NAHBNow

Feb 17, 2026

2026 Housing Outlook: Ongoing Challenges, Cautious Optimism and Incremental GainsThe housing market will continue to face several headwinds in 2026, including economic policy uncertainty as well as a softening labor market and ongoing affordability problems. But easing financial conditions led by an anticipated modest reduction in mortgage rates should help to somewhat offset these market challenges and support production and sales, according to economists speaking at the International Builders’ Show in Orlando, Fla. today.

Feb 17, 2026

Multifamily Market Expected to Cool in 2026 as Vacancies RiseThe rental market has slowed following a pandemic-era boom due to demographic changes, softer labor market and rising vacancies and is moving towards a more constrained development environment, according to economists speaking at the National Association of Home Builders (NAHB) International Builders’ Show in Orlando today.

Latest Economic News

Feb 17, 2026

Builder Sentiment Edges Lower on Affordability ConcernsBuilder confidence in the market for newly built single-family homes fell one point to 36 in February, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).

Feb 17, 2026

How Rising Costs Affect Home AffordabilityHousing affordability remains a critical issue, with 65% of U.S. households unable to afford a median-priced new home in 2026. When mortgage rates are elevated, even a small increase in home prices can have a big impact on housing affordability.

Feb 16, 2026

Cost of Credit for Builders & Developers at Its Lowest Since 2022The cost of credit for residential construction and development declined in the fourth quarter of 2025, according to NAHB’s quarterly survey on Land Acquisition, Development & Construction (AD&C) Financing.