Construction Labor Market Cools in June

The construction labor market is cooling off as economic activity slows in response to tighter monetary policy, according to the latest job openings data from the Bureau of Labor Statistics.

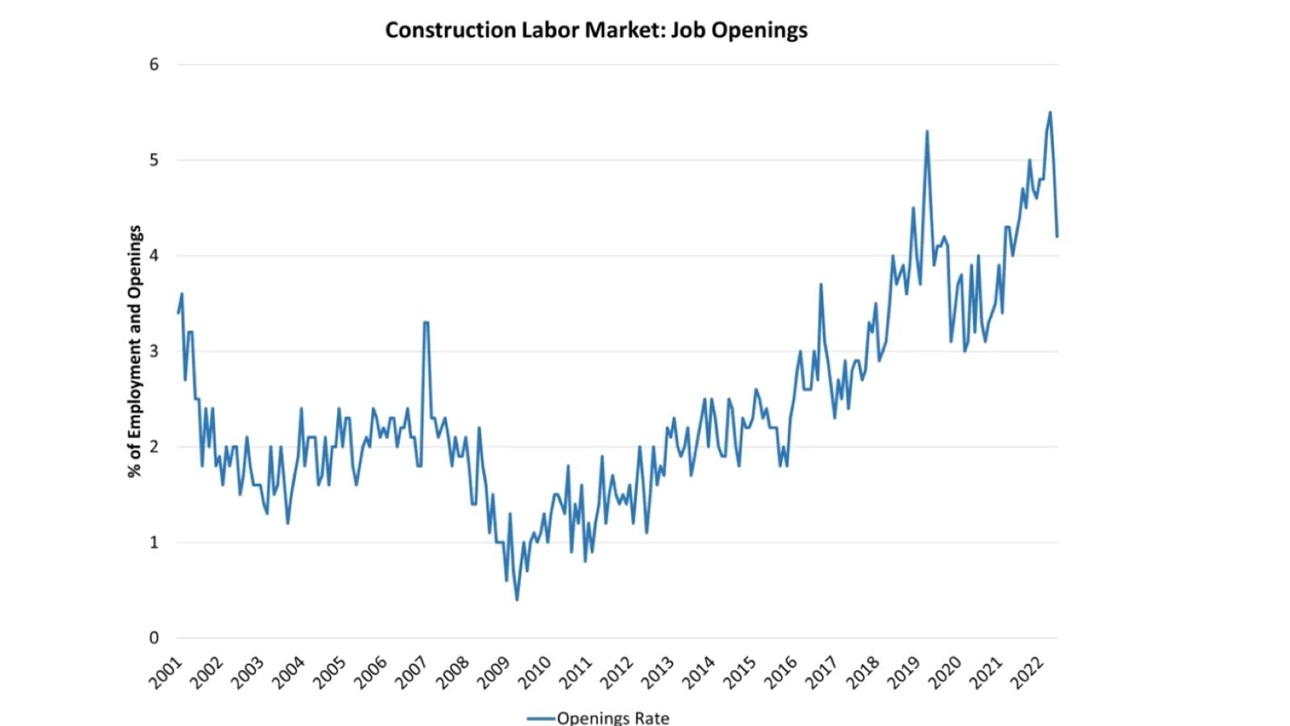

As forecasted over the last two months, the count of open construction jobs is now falling, declining from 405,000 in May to 334,000 in June. The construction job openings rate ticked down to 4.2% in June, after reaching a data series high of 5.5% in April.

The housing market remains underbuilt and requires additional labor, lots and lumber and building materials to add inventory. However, the market is slowing due to higher interest rates, yielding a slowing of the count of unfilled positions in the sector.

Hiring in the construction sector dipped to a 4.5% rate in June. The post-virus peak rate of hiring occurred in May 2020 (10.4%) as a rebound took hold in home building and remodeling.

Despite slowing of building activity, construction sector layoffs remained low at a 1.7% rate in June. In April 2020, the layoff rate was 10.8%. Since that time however, the sector layoff rate has been below 3%, with the exception of February 2021 due to weather effects.

Looking forward, attracting skilled labor will remain a key objective for construction firms in the coming years. However, while a slowing housing market will take some pressure off tight labor markets, the long-term labor challenge will persist beyond an ongoing macro slowdown.

NAHB Chief Economist Robert Dietz provides additional analysis in this Eye on Housing blog post.

Latest from NAHBNow

Feb 27, 2026

Senate Bill Would Exclude Building Materials from TariffsNAHB worked with Sens. Jacky Rosen (D-Nev.) and Chris Coons (D-Del.) to introduce legislation that would address the housing affordability crisis by creating an exemption process for building materials from tariffs.

Feb 27, 2026

New Army Corps Initiative Will Streamline Permitting ProcessThe Army Corps of Engineers on Feb. 23 announced a new initiative called “Building Infrastructure, Not Paperwork” that the agency said will “shorten permitting timelines, and reduce or eliminate extraneous regulations and paperwork.”

Latest Economic News

Feb 27, 2026

Gains for Student Housing Construction in the Last Quarter of 2025Private fixed investment for student dormitories was up 1.5% in the last quarter of 2025, reaching a seasonally adjusted annual rate (SAAR) of $3.9 billion. This gain followed three consecutive quarterly declines before rebounding in the final two quarters of the year.

Feb 27, 2026

Price Growth for Building Materials Slows to Start the YearResidential building material prices rose at a slower rate in January, according to the latest Producer Price Index release from the Bureau of Labor Statistics. This was the first decline in the rate of price growth since April of last year. Metal products continue to experience price increases, while specific wood products are showing declines in prices.

Feb 26, 2026

Home Improvement Loan Applications Moderate as Borrower Profile Gradually AgesHome improvement activity has remained elevated in the post-pandemic period, but both the volume of loan applications and the age profile of borrowers have shifted in notable ways. Data from the Home Mortgage Disclosure Act (HMDA), analyzed by NAHB, show that total home improvement loan applications have eased from their recent post-pandemic peak, and the distribution of borrowers across age groups has gradually tilted older.