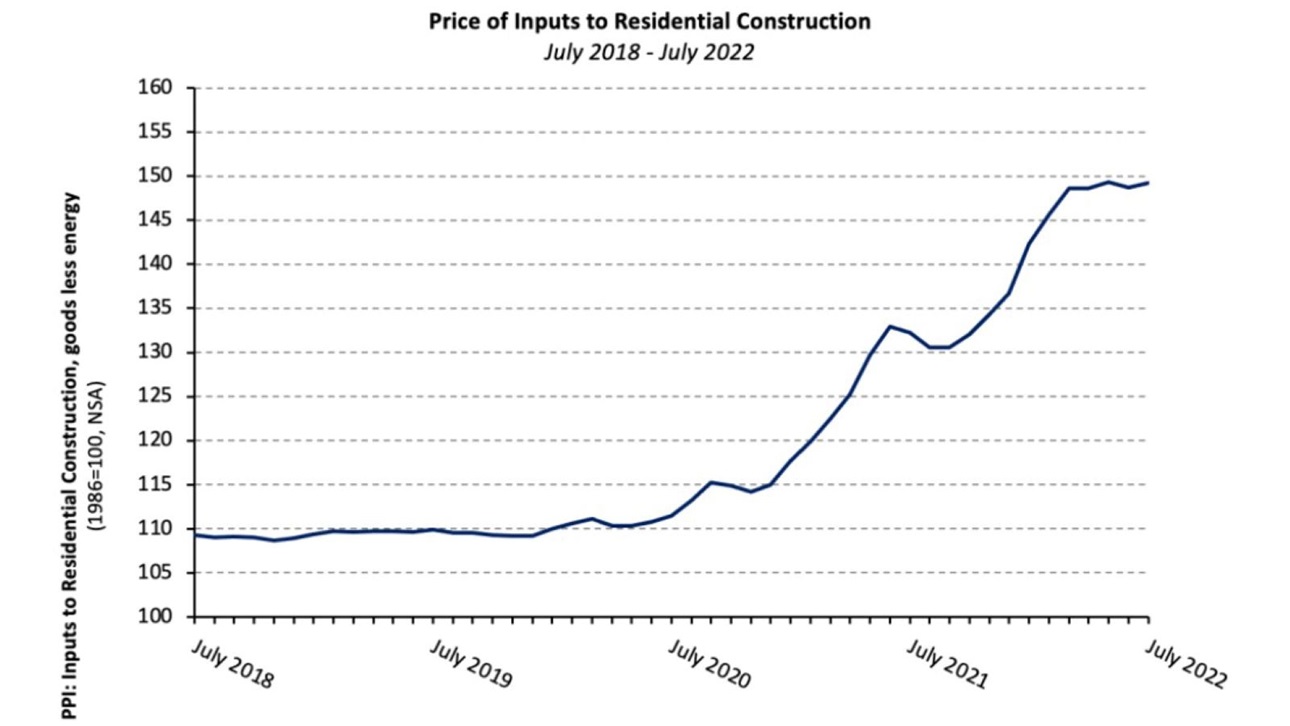

Building Material Prices Continued Climb in July

The prices of building materials rose 0.4% in July (not seasonally adjusted) even as softwood lumber prices increased 2.3%, according to the latest Producer Price Index (PPI) report. Prices have surged 35.7% since January 2020, although 80% of the increase has occurred since January 2021.

Price changes for specific products include:

- Concrete products: The PPI for ready-mix concrete (RMC) gained 2.5% in July and has increased in 17 of the last 18 months. The index has climbed 6.8%, year-to-date, the largest YTD July increase in the series’ 34-year history. The PPI for finished concrete products has climbed 14.4% over the past 12 months and the price of structural concrete block is up 12.9% over the same period. Concrete pipe and prestressed concrete products prices also have climbed 21.0% and 29.9%, respectively, since July 2021.

- Softwood lumber: The PPI for softwood lumber (seasonally adjusted) saw a modest increase (+2.3%) in July, its first increase in four months. Prices have fallen 28.2% year-to-date, although the extent to which the decrease has reached home builders and remodelers is unclear.

- Gypsum building products: The PPI for gypsum products held steady in July after increasing 0.1% in June and 7.1% in May. Prices have soared 22.6% over the past year. After a quiet 2020, the price of gypsum products climbed 23.0% in 2021 and is up 7.6% through the first half of 2022.

- Steel mill products: Prices decreased 3.7% in June following a 1.7% decline in June. over the two prior months. Although the index has fallen 10.1% since reaching its all-time high in December 2021, it is nearly twice the January 2021 level.

David Logan, NAHB Director of Tax and Trade Policy Analysis, provides additional information in this Eye on Housing blog post.

Latest from NAHBNow

Feb 17, 2026

2026 Housing Outlook: Ongoing Challenges, Cautious Optimism and Incremental GainsThe housing market will continue to face several headwinds in 2026, including economic policy uncertainty as well as a softening labor market and ongoing affordability problems. But easing financial conditions led by an anticipated modest reduction in mortgage rates should help to somewhat offset these market challenges and support production and sales, according to economists speaking at the International Builders’ Show in Orlando, Fla. today.

Feb 17, 2026

Multifamily Market Expected to Cool in 2026 as Vacancies RiseThe rental market has slowed following a pandemic-era boom due to demographic changes, softer labor market and rising vacancies and is moving towards a more constrained development environment, according to economists speaking at the National Association of Home Builders (NAHB) International Builders’ Show in Orlando today.

Latest Economic News

Feb 17, 2026

Builder Sentiment Edges Lower on Affordability ConcernsBuilder confidence in the market for newly built single-family homes fell one point to 36 in February, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).

Feb 17, 2026

How Rising Costs Affect Home AffordabilityHousing affordability remains a critical issue, with 65% of U.S. households unable to afford a median-priced new home in 2026. When mortgage rates are elevated, even a small increase in home prices can have a big impact on housing affordability.

Feb 16, 2026

Cost of Credit for Builders & Developers at Its Lowest Since 2022The cost of credit for residential construction and development declined in the fourth quarter of 2025, according to NAHB’s quarterly survey on Land Acquisition, Development & Construction (AD&C) Financing.