Building Materials Prices Start 2022 with 8% Increase

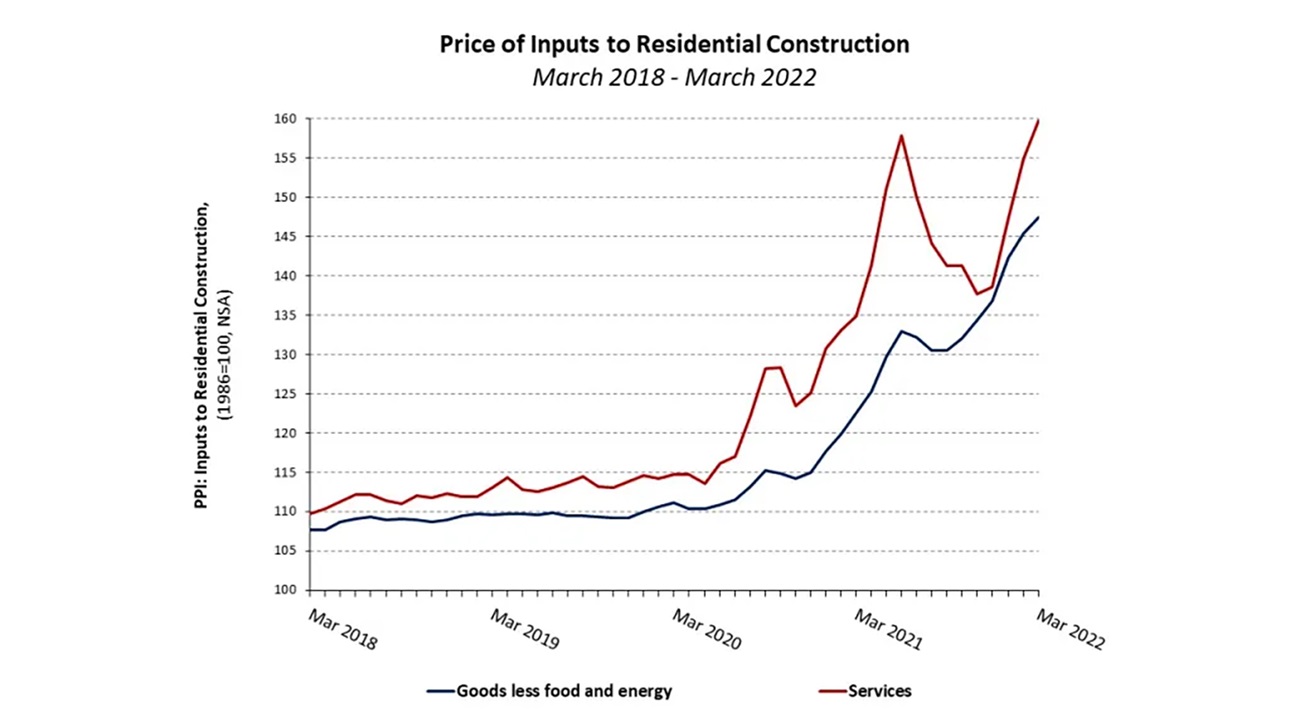

According to the latest Producer Price Index (PPI) report released by the Bureau of Labor Statistics, the prices of goods used in residential construction ex-energy (not seasonally adjusted) climbed 1.4% in March, following an upwardly revised increase of 2.2% in February and 4.1% in January. This adds up to an 8% jump in building materials prices since the start of 2022.

Building materials prices increased 20.4% year over year and have risen 33% since the start of the pandemic.

The price index of services inputs to residential construction registered even steeper increases, rising 3.2% in March, 5.1% in February and 6.2% in January. As a result, the price index of services used in home building (including trade services, transportation and warehousing) went up 15.2% since the start of the year. The index increased 18.5% year over year.

Since the start of the pandemic, services prices are now 39% higher.

Here's how PPI for individual materials have shifted during this timeframe:

- Softwood lumber increased 6% (seasonally adjusted) in March following a 2.6% increase in February and 25.6% jump in January. As a result, the index increased 36.7% over the first three months of 2022. Since reaching its most recent trough in September 2021, prices have almost doubled, rising 90.4%.

- Gypsum products increased 1.6% (seasonally adjusted) in March. Gypsum products prices are 20.8% higher year over year.

- Ready-mix concrete came down 0.6% (seasonally in March but remains elevated after climbing over the prior 13 months. It is 9% higher compared to the January 2021 reading.

- Steel products, in contrast, declined 4.9% (not seasonally adjusted) in March — the third consecutive monthly decrease after record-breaking increases over the prior 15 months. Although the first three months of 2022 have been good months for the cost of derivative steel products, the price index more than doubled since the start of the pandemic.

Natalia Siniavskaia, NAHB assistant vice president for housing policy research, provides more in this Eye on Housing post.

Latest from NAHBNow

Feb 13, 2026

Existing Home Sales in January Plunged to Lowest Level Since 2024Existing home sales in January fell to lowest level since August 2024 as tight inventory continued to push home prices higher and winter weather weighed on sales activity.

Feb 12, 2026

The Biggest Challenges Expected by Home Builders in 2026According to the latest NAHB/Wells Fargo Housing Market Index, 84% of home builders felt the most significant challenge builders faced in 2025 was high interest rates and 65% anticipate interest rates will remain a problem in 2026.

Latest Economic News

Feb 13, 2026

Inflation Eased in JanuaryInflation eased to an eight-month low in January, confirming a continued downward trend. Though most Consumer Price Index (CPI) components have resolved shutdown-related distortions from last fall, the shelter index will remain affected through April due to the imputation method used for housing costs. The shelter index is likely to show larger increases in the coming months.

Feb 12, 2026

Existing Home Sales Retreat Amid Low InventoryExisting home sales fell in January to a more than two-year low after December’s strong rebound, as tight inventory continued to push home prices higher and winter storms weighed on activity. Despite mortgage rates trending lower and wage growth outpacing price gains, limited resale supply kept many buyers on the sidelines.

Feb 12, 2026

Residential Building Worker Wages Slow in 2025 Amid Cooling Housing ActivityWage growth for residential building workers moderated notably in 2025, reflecting a broader cooling in housing activity and construction labor demand. According to the latest data from the U.S. Bureau of Labor Statistics (BLS), both nominal and real wages remained modest during the fourth quarter, signaling a shift from the rapid post-pandemic expansion to a slower-growth phase.