How Builders Are Dealing with Rising Lumber Prices

As NAHB continues to work tirelessly to combat rising lumber prices and supply shortages by aggressively engaging with the Biden administration and members of Congress, builders who are on the frontlines are engaging in several strategies to mitigate this unprecedented price surge that is raising housing costs and impacting their bottom lines.

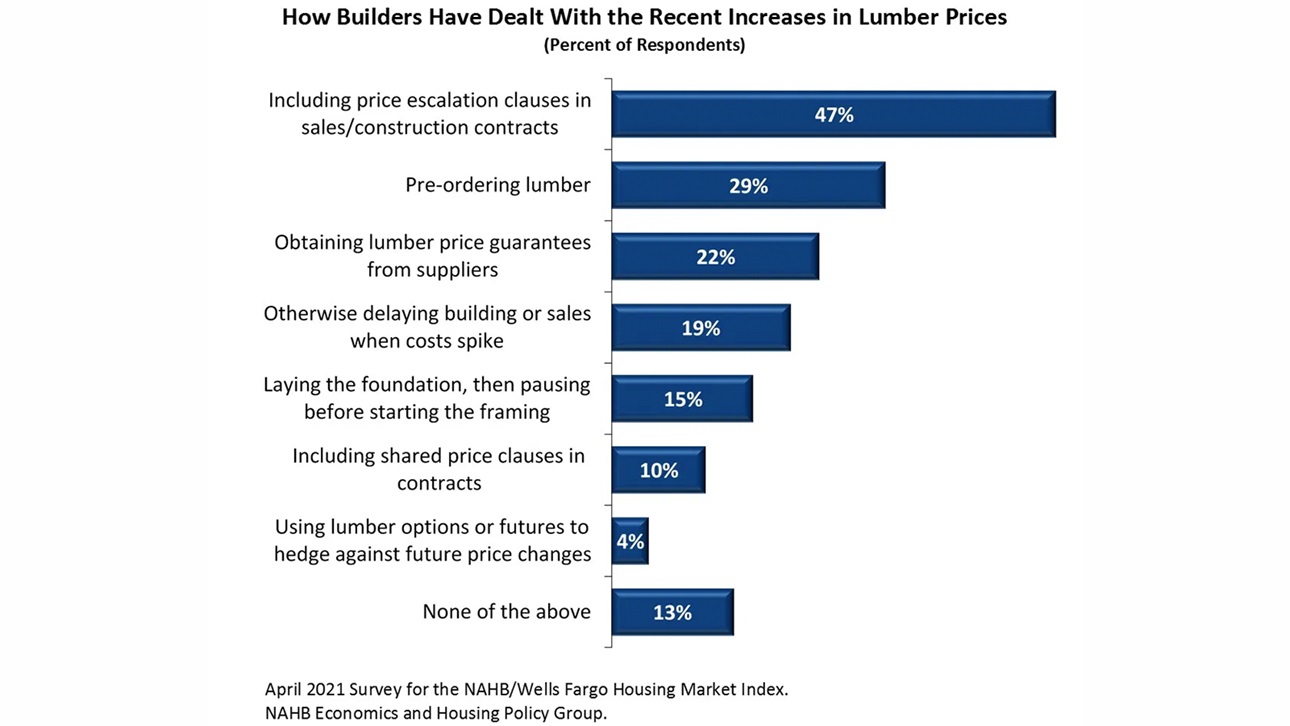

NAHB recently asked builders about their reactions to the rising and volatile lumber prices in its April 2021 survey for the NAHB/Wells Fargo Housing Market Index (HMI). Nearly half (47%) of single-family builders in the HMI panel indicated that they were including price escalation clauses in their sales contracts as their primary mitigation effort.

“It’s been a difficult time for us and home owners,” Jeremy Burke, a remodeler in Pennsylvania, shared through NAHB’s online lumber testimonial form. “We have had to prepare contracts with clauses for material change orders when materials cost rise — which I fear means we will lose contacts and/or projects for those who can’t afford the extra costs.”

Other efforts include pre-ordering lumber (29%) and obtaining lumber price guarantees from suppliers (22%). According to responses, prices were typically guaranteed for 15-29 days (42% of respondents reported) or 30-59 days (33% of respondents reported), for a median length of 28 days.

“We are pricing each unit on a case-by-case basis, and only after we have a commitment on actual lumber costs for that unit,” noted Thomas Troy, a builder in New Jersey, in a testimonial. “We are at the point where we are withholding new sections in some projects.”

Nearly one in five builders (19%) have also, unfortunately, had to delay building or sales when costs spike, and 15% indicated they are laying the foundation but pausing before framing. This puts further strain on the much-needed housing supply necessary to help make housing affordable.

“We have always prided ourselves on being able to provide affordable housing to our local market, while also being financially prudent to the best practices in the building industry,” stated Michael Welty, a builder in Colorado, in a testimonial. “When you couple these price increases with the limited amount of supply that currently resides in our housing market, the current conditions are creating an escalating market that in our opinion will eventually be unsustainable.”

Paul Emrath, vice president of surveys and housing policy research, provides more analysis and details in this Eye on Housing post.

Latest from NAHBNow

Mar 06, 2026

Bill Truex Seeks Certification as a Candidate for 2028 NAHB Third Vice ChairmanThe NAHB Nominations Committee announces that Bill Truex, president, Truex Preferred Construction in Englewood, FL, has submitted his Letter of Intent to seek certification as a candidate for NAHB 2028 Third Vice Chairman.

Mar 06, 2026

Why Builders Who Can Add Starts Quickly Win the Next Housing MoveThe next meaningful move in housing may come as a gradual shift or a sudden surge. For builders who want to be positioned for growth, Sound Capital offers insights on the financial and operational disciplines that create flexibility when markets turn.

Latest Economic News

Mar 05, 2026

Builders Identify Key Long-Term Forces Shaping Housing Demand and Industry HealthHome builders are keenly aware of the complex long-term outlook ahead for the home building industry. A recent NAHB/Wells Fargo HMI survey asked builders to assess the impact of 14 major trends and forces on the health of the industry and housing demand over the next 10 years.

Mar 05, 2026

Affordability Posts Mild Gains in Second Half of 2025 but Crisis ContinuesThough new and existing homes remain largely unaffordable, the needle moved slightly in the right direction in the second half of 2025, according to the latest data from the National Association of Home Builders (NAHB)/Wells Fargo Cost of Housing Index (CHI).

Mar 04, 2026

Mortgage Rates Dipped Below 6% in February Amid Treasury RallyMortgage rates continued to decline in February, dipping below 6% in the last week of February. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.05% last month, 5 basis points (bps) lower than January.